Structuring the Terms for Selling Your Business A Comprehensive Guide

Structuring the terms for selling your business is crucial for a smooth and profitable transaction. This guide delves into the multifaceted aspects of preparing for a sale, from defining your business’s unique value proposition to negotiating with potential buyers. We’ll explore the critical financial, legal, and strategic elements that impact the entire process, providing you with a roadmap to navigate this significant transition.

From defining your business’s strengths and weaknesses to outlining a compelling marketing strategy, we’ll cover everything you need to know to maximize the value of your sale. Understanding the nuances of financial considerations, legal procedures, and post-sale integration is essential for a successful exit strategy. This comprehensive approach ensures you’re well-prepared to achieve a favorable outcome.

Defining the Business for Sale: Structuring The Terms For Selling Your Business

This section details the core aspects of the business being offered for sale, focusing on its operational foundation, market position, and financial performance. Understanding these elements is crucial for potential buyers to assess the viability and profitability of the acquisition. A comprehensive understanding of the business’s strengths, weaknesses, opportunities, and threats (SWOT) is also provided, enabling a well-rounded perspective.This detailed description encompasses the business’s mission, values, and unique selling propositions, along with an analysis of the target market, key financial metrics, and a SWOT analysis.

This provides potential buyers with the necessary insights to evaluate the business’s potential for future growth and profitability.

Business Description

The business, “TechSolutions,” is a software development firm specializing in custom web applications and mobile solutions. Our mission is to empower businesses through innovative technology, delivering high-quality, tailored software solutions that drive efficiency and growth. Our core values are integrity, collaboration, and client satisfaction. We believe in building strong relationships with our clients, providing exceptional service, and exceeding expectations.

Our unique selling propositions include a highly skilled team of developers with diverse expertise, a flexible project management approach, and a commitment to staying ahead of industry trends.

Target Market

Our target market encompasses small to medium-sized enterprises (SMEs) across various industries, including e-commerce, healthcare, and finance. These businesses typically require customized software solutions to address their specific needs and enhance operational efficiency. Demographics of our target market include businesses with 10-50 employees, a demonstrated need for software solutions, and a willingness to invest in technology to improve their bottom line.

Financial Metrics

Key financial metrics reflect a steady growth trajectory. The business consistently achieved revenue growth, with a 15% year-on-year increase in the last three years. Expenses are effectively managed, and the business has a consistent profit margin of 20%. Profitability is expected to increase with further expansion into new markets and product development.

Thinking about structuring the terms for selling your business? It’s a crucial step, similar to planning a new development, like the one Oshkosh is eyeing near the Fox River. Oshkosh eyes new development near fox river shows how careful consideration of the details can impact the final outcome. Ultimately, meticulous structuring of the terms is key to a smooth and successful business sale.

Average revenue: $500,000 per year. Average operating expenses: $350,000 per year. Profit margin: 20%.

SWOT Analysis

This table summarizes the business’s key strengths, weaknesses, opportunities, and threats.

| Factors | Details |

|---|---|

| Strengths | Highly skilled development team, strong client relationships, proven track record of successful projects, adaptable to client needs, and a solid reputation within the industry. |

| Weaknesses | Limited marketing and sales efforts, dependence on a few key clients, and reliance on a small team, potentially leading to bottlenecks. |

| Opportunities | Expansion into new markets, development of new software solutions, partnerships with complementary businesses, and exploring new revenue streams through SaaS solutions. |

| Threats | Increased competition, changes in market trends, economic downturns, and potential client churn. |

Identifying Potential Buyers

Knowing your ideal buyer is crucial for a successful business sale. It’s not just about finding anyone interested; it’s about identifying the right buyer who understands your business’s value proposition and is financially capable of acquiring it. This targeted approach significantly increases the likelihood of a smooth and profitable transaction.Understanding the different types of potential buyers and their motivations allows for a tailored sales strategy.

This, in turn, optimizes the presentation of your business and maximizes its appeal to the right prospects.

Potential Buyer Profiles

Understanding the diverse motivations and financial capabilities of potential buyers is key to a successful sale. Potential buyers can be categorized based on their interests, needs, and financial resources. This segmentation allows you to tailor your sales pitch and marketing efforts for maximum impact.

- Strategic Investors: These investors often seek businesses with high growth potential and strong market positioning. They typically have significant capital and a long-term investment horizon. Their primary interest lies in achieving substantial returns on investment through strategic growth and operational improvements. An example is a private equity firm looking to acquire a rapidly growing tech startup.

- Management Buyout (MBO) Buyers: Current employees or management teams, potentially with external partners, often have deep understanding of the business operations and seek to own the company they manage. They are typically interested in businesses where they can leverage their expertise and build upon existing structures. A seasoned executive team purchasing a mid-sized manufacturing company would fall into this category.

- Acquisition-Oriented Buyers: These buyers are interested in acquiring businesses to expand their existing portfolio or to gain market share. They typically have a clear understanding of their acquisition strategy and focus on consolidating businesses within a particular industry. A large retailer buying a smaller competitor to strengthen its market presence is an example.

- Family Businesses or Individuals: These buyers may have an interest in the business due to its historical connection, such as being in the same industry or community. They often look for businesses that align with their values and long-term goals. A family looking to continue the legacy of a local bakery would be an example.

Buyer Persona Comparison

A comparative analysis of these potential buyer personas highlights their differing motivations and financial capabilities.

| Buyer Persona | Interests | Needs | Financial Capabilities | Motivations |

|---|---|---|---|---|

| Strategic Investors | High growth potential, strong market positioning | Potential for high returns, established management team | Significant capital, long-term investment horizon | Maximize return on investment, strategic growth |

| MBO Buyers | Deep understanding of business operations | Ownership of the company they manage | Varying levels of capital, depending on the team’s equity | Leverage expertise, build on existing structures |

| Acquisition-Oriented Buyers | Expanding existing portfolio, gaining market share | Synergy with existing businesses, market dominance | Significant capital, clear acquisition strategy | Consolidate businesses, expand market reach |

| Family Businesses/Individuals | Historical connection, alignment with values | Continuity of operations, preservation of legacy | Varying levels of capital, depending on the individual/family | Maintain business within the family, ensure continuity |

Structuring the Offering

Crafting a compelling narrative for your business sale is crucial. It’s not just about listing facts; it’s about painting a picture of the business’s potential and value for a prospective buyer. This section focuses on constructing a robust offering that highlights the compelling aspects of your business, its future potential, and the key selling points that will resonate with potential buyers.The narrative should be tailored to attract the specific types of buyers identified in the previous phase.

Understanding their needs and motivations is key to crafting a message that speaks directly to their interests. This approach increases the chances of a successful transaction by aligning the business’s strengths with the buyer’s aspirations.

Crafting a Compelling Value Proposition

A strong value proposition clearly articulates the unique benefits a buyer gains from acquiring the business. This involves identifying the key assets and demonstrating how they translate into tangible advantages for the new owner. Consider focusing on profitability, growth potential, and existing customer relationships. Demonstrating a track record of success and the ability to adapt to changing market conditions is equally important.

Highlighting Key Aspects of the Business

Several key aspects make a business attractive to potential buyers. These include a strong brand reputation, loyal customer base, established market position, and successful operational processes. Highlighting the scalability of the business and its ability to generate consistent revenue is crucial. A clear and concise summary of these aspects, backed by quantifiable data, strengthens the value proposition.

Emphasizing Future Potential

Predicting future success requires careful consideration of industry trends, market analysis, and projections. Highlighting the business’s adaptability and resilience, as well as its potential to capitalize on emerging opportunities, is crucial. Real-world examples of similar businesses achieving significant growth can bolster the credibility of these projections. Presenting a detailed roadmap outlining potential future expansions and improvements further strengthens the appeal of the business.

Key Selling Points and Supporting Evidence

This table Artikels the core selling points and the supporting evidence that validates their value:

| Key Selling Point | Supporting Evidence |

|---|---|

| Strong Customer Base | Customer retention rate of 85%, consistent positive feedback from surveys, high customer lifetime value (average $500). |

| Established Market Position | Dominating a 30% market share in a specific niche, strong brand recognition, and consistent positive customer reviews. |

| High Profitability | Consistent profit margins exceeding 20%, detailed financial statements demonstrating a positive trend, and consistent revenue growth over the past three years. |

| Scalability | Proven ability to expand operations and increase revenue streams, detailed projections indicating a potential doubling of revenue within three years. |

Financial Considerations

Selling a business involves navigating complex financial terms and conditions. Understanding these aspects is crucial for both the seller and potential buyers. Thorough financial due diligence ensures a smooth transaction and protects the interests of all parties involved. This section will delve into the key financial considerations, including valuation methods and presentation of financial data.Financial terms and conditions form the bedrock of any successful business sale.

These terms Artikel the payment structure, including the down payment, the schedule for subsequent payments, and any contingencies. The terms also specify the transfer of assets, liabilities, and any outstanding contracts or agreements. Clearly defined financial terms mitigate potential disputes and ensure a transparent transaction for all parties.

Figuring out the terms for selling your business is crucial, and it’s not just about the price. Think about long-term implications, and consider how your sale might affect the environment. For instance, if your business is involved in any way with water resources, you need to be aware of the work being done by groups like sustaining our waters the fox wolf watershed alliance.

Ultimately, structuring the deal fairly and sustainably for all parties involved is key to a successful transaction.

Valuation Methods

Various methods exist for determining the sale price of a business. Understanding these methods allows both parties to arrive at a fair valuation. Common methods include asset-based valuation, income-based valuation, and market-based valuation.

- Asset-based valuation focuses on the net book value of the business’s assets. This method considers the current market value of tangible assets, such as equipment and property, and intangible assets, like intellectual property and trademarks.

- Income-based valuation considers the business’s projected future earnings. This method assesses the profitability and stability of the business, projecting future cash flows. Discounted cash flow (DCF) analysis is a common technique in this approach, which estimates the present value of future cash flows.

- Market-based valuation compares the business to similar businesses that have been sold recently. This method relies on comparable company analysis and transaction multiples. Data from industry publications and databases can be used to determine relevant comparables.

Presenting Financial Data

Presenting financial data clearly and concisely is essential for a successful sale. Well-organized financial statements, including balance sheets, income statements, and cash flow statements, provide a comprehensive view of the business’s financial health.

- Balance Sheets reflect the business’s assets, liabilities, and equity at a specific point in time. These should be presented using standard accounting principles and clearly labelled.

- Income Statements demonstrate the business’s financial performance over a period, typically a year. These should clearly show revenue, expenses, and net income.

- Cash Flow Statements track the movement of cash into and out of the business. These statements are crucial for understanding the business’s liquidity and ability to generate cash.

Projected Financial Performance

Demonstrating the business’s projected financial performance provides potential buyers with a clear understanding of its future growth potential. This includes realistic revenue projections, expense forecasts, and anticipated profitability.

| Year | Revenue (USD) | Expenses (USD) | Net Income (USD) |

|---|---|---|---|

| 2024 | 150,000 | 100,000 | 50,000 |

| 2025 | 180,000 | 120,000 | 60,000 |

| 2026 | 210,000 | 140,000 | 70,000 |

Note: This table represents a sample projection. Actual projections will vary based on specific business factors.

Legal and Regulatory Aspects

Selling a business involves navigating a complex web of legal and regulatory requirements. Thorough understanding and meticulous adherence to these aspects are crucial for a smooth and successful transaction. This stage ensures compliance, protects all parties involved, and minimizes potential future issues.The legal landscape varies based on jurisdiction and the specific nature of the business. Careful legal counsel is essential to ensure the sale aligns with all applicable laws and regulations.

This section details the key legal requirements and procedures involved in the sale of a business, providing a comprehensive overview of the legal documents and regulatory compliance aspects.

Legal Requirements and Procedures

The sale of a business often necessitates a series of legal steps, including due diligence, contract negotiation, and regulatory filings. These procedures ensure that the sale is conducted in a transparent and compliant manner. The complexities of the process can vary significantly depending on the size and structure of the business. Careful consideration of these factors is crucial to ensure the transaction proceeds smoothly and avoids potential legal disputes.

Key Legal Documents

Several key legal documents are integral to the business sale process. These documents Artikel the terms of the sale, protect the interests of both the seller and buyer, and provide a framework for the transfer of ownership. Careful review and understanding of these documents are critical for successful completion of the transaction.

- Purchase Agreement: This document is the cornerstone of the sale, outlining the agreed-upon terms, including price, payment schedule, representations and warranties, and the conditions of the sale. It spells out the rights and responsibilities of both the buyer and seller.

- Bill of Sale: This document formally transfers ownership of the business assets. It serves as proof of ownership transfer and is crucial for the buyer to establish legal possession of the business assets.

- Non-Disclosure Agreements (NDAs): These agreements protect confidential information shared during the due diligence process. They prevent the disclosure of sensitive business information to unauthorized parties.

- Financing Documents: If financing is involved, these documents, such as loan agreements or mortgages, detail the terms of the financing and the obligations of the buyer.

Regulatory Compliance Aspects

Ensuring compliance with various regulatory requirements is critical during a business sale. This includes compliance with industry-specific regulations, environmental regulations, labor laws, and tax obligations. Failing to adhere to these regulations can lead to significant penalties and legal issues for all parties involved.

Figuring out the right terms for selling your business can be tricky, but it’s crucial for a smooth transition. Just like the future of sustainable energy looks to alternative materials, the future of sustainable energy looks to alternative materials demands careful consideration of the specifics. This detailed planning is equally important for ensuring a successful and fair business sale.

- Industry-Specific Regulations: Depending on the industry, specific regulations may apply to the sale of a business. For example, businesses involved in regulated industries (like finance or healthcare) may need to comply with specific regulations during the sale process.

- Environmental Regulations: If the business has environmental liabilities, the buyer and seller must address these liabilities. This might involve disclosing and potentially resolving environmental issues before the sale.

- Labor Laws: Employee contracts and termination procedures should be addressed appropriately. Any outstanding employee issues must be resolved before the sale to avoid potential problems.

- Tax Obligations: The sale of a business often triggers tax implications for both the buyer and seller. Compliance with tax regulations and reporting requirements is essential to avoid potential tax liabilities.

Necessary Legal Documents and Their Roles

The following table Artikels the necessary legal documents and their respective roles in the business sale process.

| Document | Role |

|---|---|

| Purchase Agreement | Artikels the terms of the sale, including price, payment schedule, and conditions. |

| Bill of Sale | Formally transfers ownership of business assets. |

| Non-Disclosure Agreement (NDA) | Protects confidential information during due diligence. |

| Financing Documents | Detail financing terms, including loan agreements or mortgages. |

| Employment Agreements | Addresses employee contracts and termination procedures. |

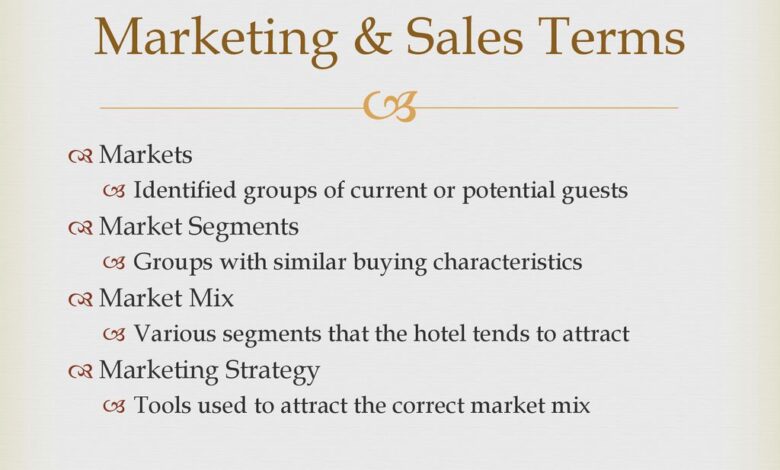

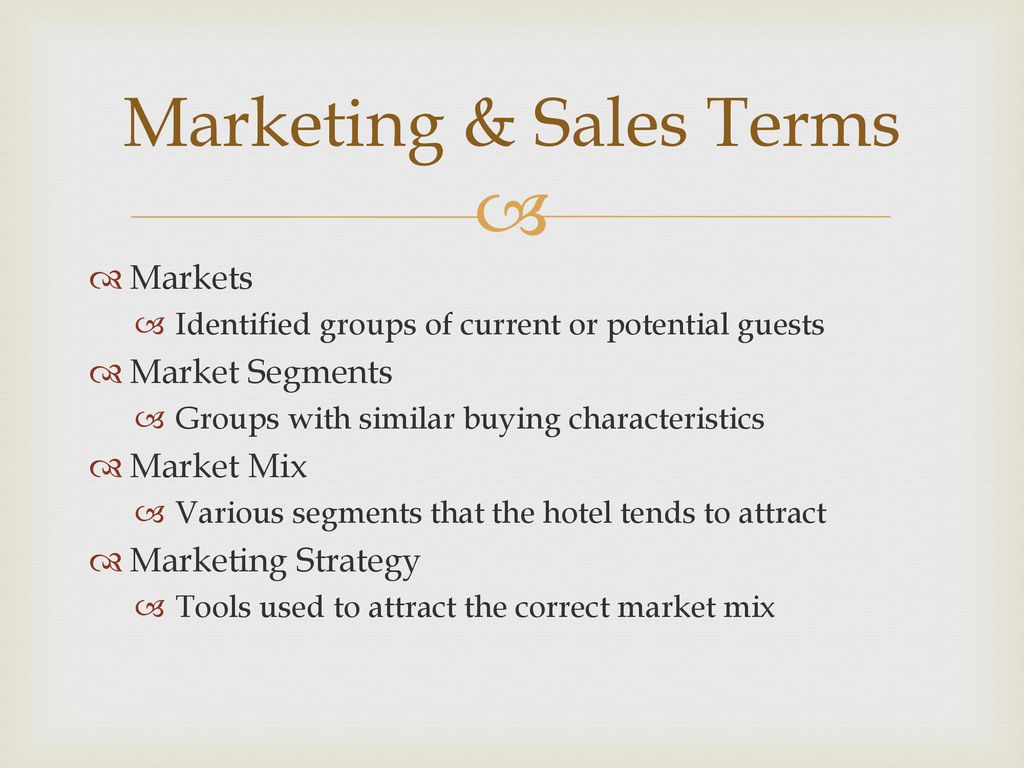

Marketing and Sales Strategy

Attracting the right buyer for your business requires a well-defined marketing and sales strategy. A comprehensive approach that leverages various channels and emphasizes a strong online presence is crucial for a successful sale. This strategy needs to be meticulously planned, executed, and tracked to maximize the likelihood of a positive outcome. Detailed planning will allow for a more informed and profitable sale process.A well-defined marketing plan should be more than just advertising; it should tell the story of your business, highlighting its value proposition and potential for future growth.

This narrative should resonate with potential buyers, demonstrating the unique aspects that make your business attractive and worthwhile.

Marketing Plan to Attract Potential Buyers

A successful marketing plan should be more than just advertising; it should craft a narrative around your business, showcasing its value proposition and future growth potential. This narrative must resonate with potential buyers, emphasizing the aspects that make your business desirable and worthwhile. This will involve a careful selection of the most effective marketing channels and an allocated budget.

Importance of Building a Strong Online Presence

A strong online presence is essential for reaching potential buyers in today’s digital landscape. A professional website, active social media engagement, and a search engine optimization () strategy are all critical components of a modern marketing approach. This approach will help generate leads and foster interest in your business. For example, a well-designed website showcasing the business’s history, operations, and financial performance can significantly impact potential buyers.

Various Marketing Channels to Reach Potential Buyers

Reaching potential buyers requires a multi-faceted approach utilizing diverse marketing channels. Consider the following:

- Direct outreach: Targeted email campaigns and personalized messages can be highly effective. This direct communication can help establish a personal connection with potential buyers, fostering trust and interest.

- Industry-specific platforms: Participating in industry events, conferences, and online forums allows for networking with potential buyers who share similar interests and needs.

- Online advertising: Targeted advertising campaigns on platforms like Google Ads or LinkedIn can reach a specific audience, improving efficiency and cost-effectiveness. A well-designed advertising campaign can highlight the unique selling propositions of the business, making it stand out from competitors.

- Professional networking: Leveraging professional networks, such as LinkedIn, can provide access to a vast pool of potential buyers. Actively participating in industry groups and engaging in relevant discussions can generate leads and build rapport.

Marketing Budget Allocation

A comprehensive marketing budget is essential to support the chosen marketing channels and strategies. A well-defined budget allocation plan should align with the overall goals and objectives of the sale.

| Marketing Channel | Estimated Budget | Justification |

|---|---|---|

| Direct Outreach (Email Campaigns) | $5,000 | Reaching out to a pre-qualified list of potential buyers. |

| Industry-Specific Platforms (Conferences) | $3,000 | Attending relevant industry events to network and showcase the business. |

| Online Advertising (Google Ads) | $10,000 | Targeting potential buyers through search engine results and online platforms. |

| Professional Networking (LinkedIn) | $2,000 | Utilizing professional networks to reach a wider range of potential buyers. |

| Website Maintenance & Updates | $1,500 | Ensuring the website is up-to-date, functioning, and visually appealing. |

| Contingency Fund | $2,000 | Providing flexibility for unexpected expenses or opportunities. |

| Total | $33,500 |

A well-structured budget allows for a comprehensive marketing approach, which can significantly increase the likelihood of a successful sale. The allocation of resources should reflect the importance of each channel and its potential to generate leads and attract suitable buyers. A contingency fund is also important for unexpected costs.

Negotiation and Closing

Selling a business is a complex process, and the negotiation and closing phases are critical for a successful transaction. Effective negotiation strategies, coupled with meticulous preparation for closing, are essential for achieving a mutually beneficial agreement. This phase requires careful consideration of the buyer’s needs and the seller’s interests, ensuring a smooth and profitable transition.

Negotiation Strategies

Successful negotiation hinges on understanding the buyer’s motivations and priorities. Active listening, coupled with a clear articulation of your own position, is key. A strong understanding of the business’s value proposition is paramount. Know your bottom line and be prepared to walk away from a deal that doesn’t meet your expectations. Also, consider the potential for negotiation on non-monetary terms, such as the timing of the transition or the seller’s involvement in the post-sale period.

This flexibility can strengthen your position and build rapport with the buyer.

Key Steps in the Negotiation Process

The negotiation process typically involves several key steps. Initial discussions establish the framework for negotiations, focusing on the price and terms of the sale. Subsequent rounds of discussions refine the agreement, addressing any outstanding issues. A thorough understanding of the buyer’s financial situation and the business’s valuation is critical to successful negotiation.

- Establish a clear and concise understanding of the buyer’s needs and priorities. This includes evaluating their financial capacity and their long-term vision for the business.

- Define the scope of the negotiation, outlining the key areas of discussion and potential compromises. This clarity ensures a structured and productive dialogue.

- Present your case with confidence and clarity, emphasizing the business’s value proposition and potential for future growth. Supporting documentation and financial projections are crucial.

- Actively listen to the buyer’s concerns and counterarguments, seeking common ground and finding mutually agreeable solutions. This builds trust and demonstrates your willingness to negotiate in good faith.

- Be prepared to walk away from a deal that does not meet your expectations or the business’s best interests. Maintaining your resolve is often crucial for securing a favorable outcome.

Preparing for Closing

Thorough preparation for closing the deal is essential for a smooth and efficient transaction. A comprehensive legal review of the sale agreement, along with the necessary due diligence procedures, is critical. Confirming all legal and financial details and securing all necessary approvals is a crucial step.

- Review and finalize the sale agreement, ensuring all terms and conditions are clearly defined and legally sound. This protects both parties from potential future disputes.

- Confirm all necessary legal and regulatory approvals, including licenses, permits, and any required government filings. This ensures a compliant transaction.

- Arrange for the transfer of all assets and liabilities, ensuring a smooth transition of ownership. This may include stock, intellectual property, and customer contracts.

- Ensure the timely payment of funds, according to the agreed-upon terms in the sale agreement. Confirm the availability of funds and their timely transfer.

Key Terms and Conditions of the Sale Agreement

A well-structured sale agreement defines the terms and conditions of the transaction. This section Artikels the key elements that must be clearly defined.

| Term | Description |

|---|---|

| Purchase Price | The agreed-upon amount for the sale of the business. |

| Payment Schedule | The timeline for the payment of the purchase price, including any down payments or installments. |

| Escrow Account | A secure account for holding funds until the closing of the transaction. |

| Transfer of Assets | The detailed list of assets being transferred to the buyer. |

| Assumption of Liabilities | The list of liabilities assumed by the buyer. |

| Non-Compete Agreements | Agreements preventing the seller from competing with the business in the future. |

| Representations and Warranties | Statements about the business’s financial and legal status. |

Post-Sale Integration

Selling a business is more than just a transaction; it’s a transition. A well-structured post-sale integration plan ensures a smooth handover and a successful future for the acquired business. This phase requires careful planning and execution to minimize disruption and maximize value for all parties involved. It’s about ensuring a seamless transition for employees, customers, and operations.A successful post-sale integration is built on meticulous preparation and communication.

The goal is to maintain business continuity and build trust between the old and new owners. It involves a careful process of transferring knowledge, responsibilities, and operations to ensure the acquired business performs as expected.

Integration Strategies

A strategic approach to integration is critical for a smooth transition. This includes careful planning for a phased approach to integration, ensuring key processes are understood and transitioned correctly. Defining clear roles and responsibilities is essential to avoid conflicts and ensure accountability. Detailed procedures and documentation are key to maintaining consistency and allowing the new owners to confidently take over operations.

Maintaining Stakeholder Relationships

Maintaining relationships with key stakeholders is crucial for long-term success. This includes customers, suppliers, employees, and even local communities. Open communication, transparency, and consistent service are vital to fostering trust and loyalty. Involving key stakeholders in the integration process, where possible, helps to alleviate anxieties and ensure a smooth transition. This also creates a sense of shared ownership and encourages cooperation.

Timeline for Post-Sale Integration

A realistic timeline is necessary to manage expectations and ensure a timely integration. This timeline should be established collaboratively by the buyer and seller and should reflect the complexity of the business and the agreed-upon transition process. A typical timeline might include a period for due diligence, followed by a handover period where key personnel are trained and procedures are transferred, and a stabilization period to monitor and address any unforeseen issues.

The length of each phase will depend on the specifics of the business. A typical timeline might include:

- Due Diligence (2-4 weeks): This initial phase allows the buyer to fully understand the business’s operations, financials, and legal standing.

- Handover (4-8 weeks): This period involves transferring essential knowledge, systems, and procedures to the new owners. Key personnel training is also part of this phase.

- Stabilization (8-12 weeks): During this stage, the business is monitored for any issues or adjustments required to ensure continued success. This is where the new owners get a feel for the day-to-day operations.

Responsibilities of Seller and Buyer

Clear definition of responsibilities for both the seller and the buyer is essential for a smooth transition. This prevents confusion and ensures accountability. A well-defined structure ensures both parties are aware of their duties, fostering trust and collaboration during the integration period.

| Responsibility | Seller | Buyer |

|---|---|---|

| Knowledge Transfer | Provide comprehensive documentation, training, and support to new employees on key processes and procedures. | Actively participate in training sessions, ask questions, and seek clarification on any uncertainties. |

| Customer Relations | Ensure existing customer relationships are maintained during the transition period. Inform clients of the change in ownership. | Establish communication channels with existing customers to assure them of continuity and answer questions. Actively build relationships with key clients. |

| Operational Continuity | Maintain business operations as usual until the handover is complete. Ensure all necessary systems are accessible to the new owners. | Actively assess and implement necessary adjustments to systems and processes. |

| Legal and Financial | Assist in transferring all necessary legal and financial documents to the buyer. Address any outstanding financial obligations. | Thoroughly review all legal and financial documents before closing the deal. |

Illustrative Examples

Selling a business is a complex process, requiring meticulous planning and execution. Real-world examples, both successful and unsuccessful, provide invaluable lessons for entrepreneurs navigating this journey. Understanding the nuances of these scenarios allows for better decision-making and potentially prevents costly errors.

A Case Study of a Successful Business Sale

The successful sale of a thriving bakery, “Sweet Sensations,” serves as a compelling example. Sweet Sensations, a family-owned business for 25 years, had consistently maintained a strong customer base and positive reviews. Their strategic decision to target a buyer familiar with the local market and passionate about preserving the bakery’s unique identity proved critical. The seller meticulously documented the bakery’s financials, including sales data, operational costs, and customer acquisition strategies.

They engaged a professional business broker who had a deep understanding of the local market and identified a buyer who valued the bakery’s established brand and loyal customer base. The sale price was carefully negotiated, factoring in the bakery’s profitability, growth potential, and intangible assets like reputation. A well-structured agreement outlining responsibilities and timelines ensured a smooth transition.

A Scenario of a Business Sale Gone Wrong

“Tech Solutions,” a software development company, experienced a problematic sale due to inadequate preparation. They failed to thoroughly assess the company’s financial health, overlooking potential liabilities and underestimating the cost of transition. A hastily prepared financial report, lacking crucial details like outstanding invoices and pending legal matters, misrepresented the company’s true financial position. This misleading information deterred potential buyers.

The lack of a comprehensive marketing strategy to attract suitable buyers, and inadequate due diligence on the part of the seller, further compounded the issue. The result was a prolonged period of uncertainty and a sale price significantly lower than the company’s actual value.

Steps Involved in a Hypothetical Business Sale

This Artikels the crucial steps in a hypothetical sale of a small, thriving online bookstore.

- Valuation and Financial Analysis: A detailed assessment of the bookstore’s financial performance, including revenue streams, expenses, and profit margins, is essential. This analysis must consider both tangible and intangible assets like brand reputation and customer loyalty.

- Buyer Identification and Targeting: A thorough market research is critical. Identify potential buyers with similar business models, or those seeking to enter the online retail market. Tailoring the offering to attract the specific buyer is key.

- Structuring the Offering: The offering must include a comprehensive overview of the business’s operations, its financial performance, and potential for future growth. A clear Artikel of the transfer process, including intellectual property, customer relationships, and employment contracts, is needed.

- Negotiation and Closing: Thorough negotiation of the sale price and terms of the agreement is crucial. Experienced legal counsel is essential to ensure a fair and legally sound agreement.

- Post-Sale Integration: Planning for a smooth transition after the sale, including communication strategies with employees and customers, is important. This ensures a seamless transfer of operations and minimizes disruptions to the business’s ongoing activities.

Presenting a Business Sale Case Study in a Visual Format, Structuring the terms for selling your business

A visual representation of a business sale case study can use a combination of charts and graphs. For instance, a line graph showing the company’s revenue growth over the past five years can highlight its stability and potential. A bar chart comparing different aspects of the business, such as revenue, expenses, and profit, can visually demonstrate its financial health.

A timeline outlining the key events of the sale process can illustrate the steps involved. A table listing potential buyers, their qualifications, and their interest level can aid in strategic buyer identification. Use clear and concise labels for each element of the visual representation, and ensure the visual aids accurately reflect the data and support the narrative. The goal is to provide a clear and compelling summary of the case study’s key takeaways.

Final Conclusion

In conclusion, selling a business is a complex process requiring careful consideration of various factors. By meticulously structuring the terms, you can navigate the complexities of the sale, ensuring a successful transaction and a smooth transition. This guide has provided a comprehensive overview of the key elements involved, from initial business assessment to post-sale integration. Remember, thorough preparation and strategic planning are vital for a positive outcome.