Baby Steps to Retirement Prudentials Guide

‘Baby steps’ toward retirement: Prudential gives Generation Beta a – Baby steps toward retirement: Prudential gives Generation Beta a roadmap to financial freedom. This isn’t about overnight riches, but about building a solid foundation early. Generation Beta faces unique challenges, but with careful planning, a little help from Prudential, and a commitment to smart financial habits, they can confidently navigate the path to retirement.

The article explores Prudential’s tailored approach, outlining key steps for early retirement planning. It delves into financial literacy, investment strategies, and addressing specific challenges Generation Beta might encounter. The goal is to empower this generation with the knowledge and tools to achieve their retirement dreams, one baby step at a time.

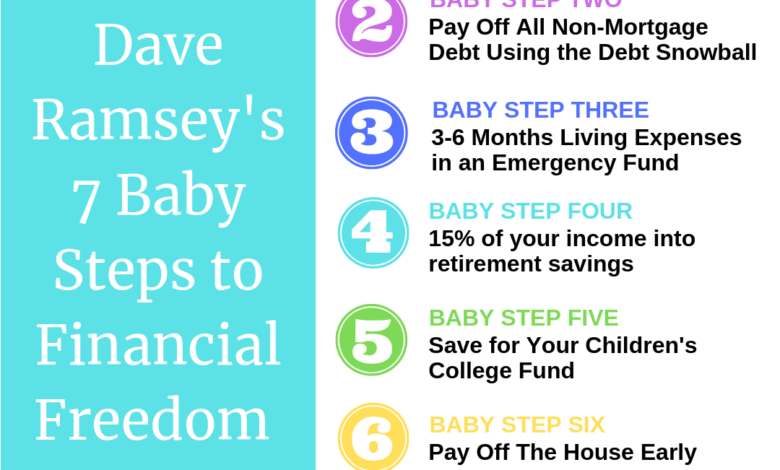

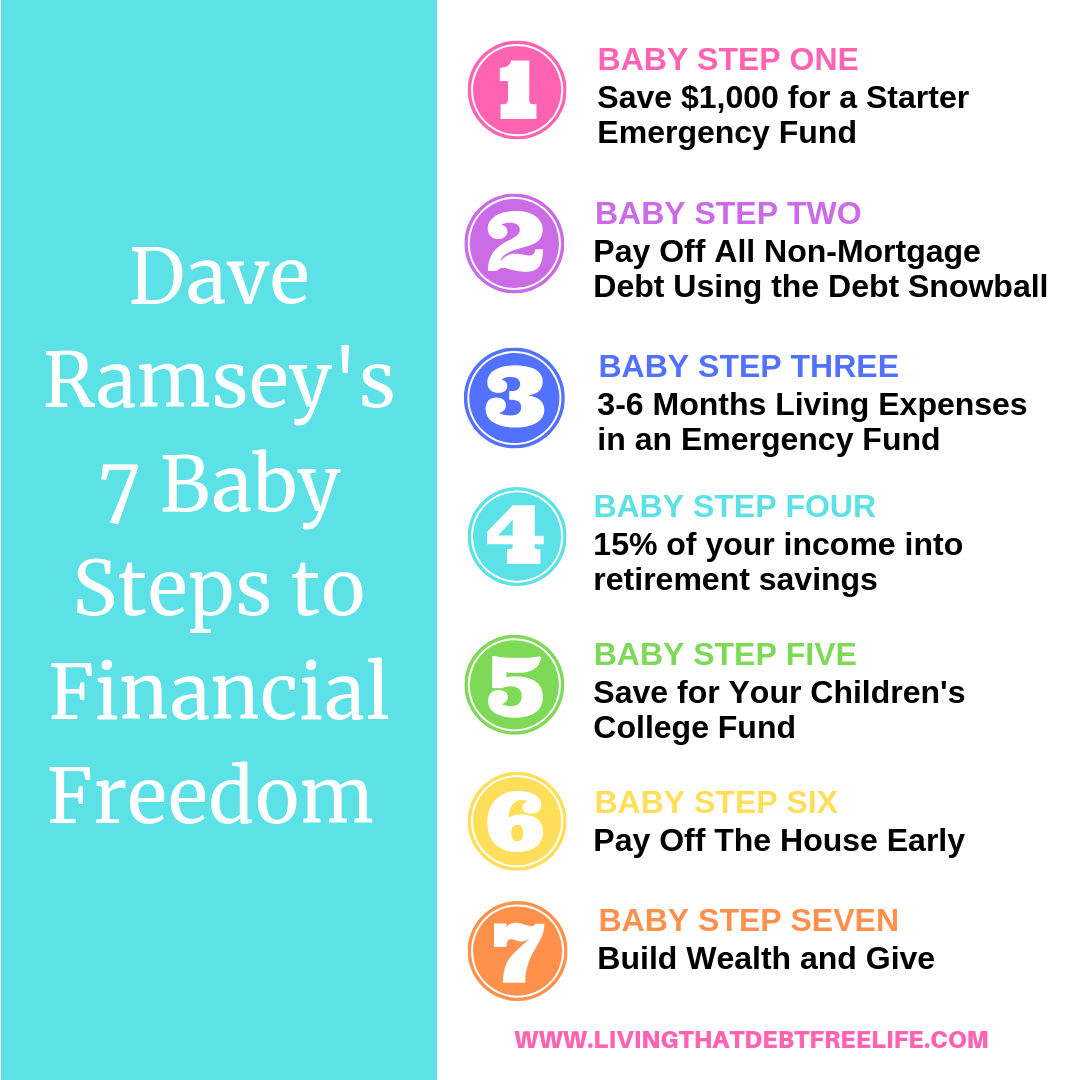

Baby Steps Toward Retirement

Retirement planning, often perceived as a daunting task, doesn’t have to be a marathon. Taking “baby steps” – small, consistent actions – can make a significant difference, especially when starting early. This approach allows for gradual progress, avoiding overwhelming feelings and fostering a sense of accomplishment along the way. It’s about building a solid foundation for financial security in retirement, one step at a time.Early planning for retirement is crucial, particularly for Generation Beta.

This generation, often digitally native and accustomed to instant gratification, may not instinctively embrace long-term financial strategies. Baby steps provide a structured framework to bridge the gap between current lifestyle and future retirement goals, promoting discipline and financial awareness. The key is to build good habits early, rather than trying to overhaul everything at once.

Defining Baby Steps in Retirement Planning

Baby steps in retirement planning are characterized by small, achievable financial goals, implemented consistently over time. These steps are designed to be manageable and sustainable, fostering a long-term commitment to retirement security rather than a sudden, overwhelming change. This approach emphasizes the importance of consistent, disciplined saving and investing, even with modest amounts, rather than expecting large lump sums upfront.

Significance of Early Planning for Generation Beta

Generation Beta, often known for their adaptability and technological savvy, frequently faces immediate gratification challenges. Early planning addresses this by establishing a clear roadmap towards retirement. This approach promotes a practical and sustainable approach to financial planning, ensuring that retirement goals are not viewed as a distant, abstract concept, but rather as a tangible outcome achievable through consistent effort.

Key Characteristics of Generation Beta

Generation Beta possesses unique characteristics that make baby steps particularly relevant. They are digitally savvy, often comfortable with technology-driven financial tools, and more open to flexible and adaptive planning. This generation’s adaptability to technology-driven financial tools can be leveraged for effective baby-step planning. They are also adept at using technology to track progress, which further encourages consistent effort.

Stages of Retirement Planning

Retirement planning is a journey, not a destination. A structured approach, like the baby steps method, helps break down the process into manageable stages. This allows for consistent progress, rather than feeling overwhelmed by the enormity of the goal.

| Stage | Focus | Actions | Timeline |

|---|---|---|---|

| Initial Savings | Building a foundation, establishing a savings routine. | Setting up a savings account, budgeting, automating transfers. | Early 20s – Mid 30s |

| Investment Beginnings | Exploring low-risk investment options, gradually increasing portfolio size. | Opening a retirement account (401k, IRA), learning about diversified investment strategies. | Mid 30s – Early 40s |

| Diversification & Growth | Expanding investment portfolio, increasing risk tolerance (as appropriate). | Adding stocks to portfolio, researching various investment vehicles, seeking professional advice. | Late 40s – Early 50s |

| Preservation & Growth | Managing existing investments, focusing on preservation of capital. | Rebalancing portfolio, reviewing investments, considering estate planning. | 50s – Retirement |

Prudential’s Approach to Baby Steps

Prudential, a leading financial services provider, recognizes the unique challenges and opportunities faced by Generation Beta as they navigate the path to retirement. Their “Baby Steps” program acknowledges the importance of starting early and building a solid foundation for financial security in the long term. This approach aims to empower individuals to take control of their financial future through small, consistent actions.Prudential’s “Baby Steps” program is designed to be flexible and adaptable to different financial situations, guiding Generation Beta through the various stages of retirement planning.

It emphasizes the importance of developing sound financial habits early on and stresses the compounding effect of early savings and investments.

Prudential’s Specific Strategies

Prudential’s strategies for guiding Generation Beta towards retirement revolve around a phased approach. This includes encouraging individuals to establish a clear retirement vision, focusing on achievable goals, and developing a personalized savings plan. They offer tools and resources to help track progress and stay motivated.

Actionable Steps for Early Retirement Planning

Prudential recommends a series of actionable steps for early retirement planning, starting with creating a detailed budget and tracking expenses. This step helps individuals understand their spending habits and identify areas where they can save. Next, they suggest establishing an emergency fund to safeguard against unexpected financial setbacks. Finally, Prudential encourages the development of a diversified investment portfolio, considering risk tolerance and long-term goals.

These actions are designed to build financial stability and create a foundation for future growth.

Potential Benefits and Drawbacks

Prudential’s “Baby Steps” approach offers several potential benefits. For instance, early planning can mitigate the risk of running out of money in retirement. It can also help individuals build a sense of control over their financial future, reducing stress and anxiety. However, drawbacks may arise for individuals with unpredictable income or high short-term financial needs. The long-term nature of retirement planning requires patience and discipline, which may be challenging for some.

Furthermore, the approach’s effectiveness depends on individual commitment and financial literacy.

Comparison to Other Retirement Planning Programs

| Feature | Prudential’s Baby Steps | Vanguard’s Retirement Planning | Schwab’s Retirement Planning | Fidelity’s Retirement Planning |

|---|---|---|---|---|

| Focus | Phased approach, building consistent habits | Investment portfolio diversification | Low-cost investment options | Comprehensive financial planning |

| Target Audience | Generation Beta, early savers | Broad range of investors | Individuals seeking low-cost options | Individuals needing comprehensive financial planning |

| Key Strategies | Budgeting, emergency fund, diversified investments | Index funds, ETFs, mutual funds | Low-fee investment options, robo-advisors | Retirement planning tools, financial advisors |

| Cost | Variable, depending on chosen products | Typically low-cost investment options | Typically low-cost investment options | Variable, depending on services |

This table provides a general comparison of Prudential’s program to other popular retirement planning programs, highlighting their key features, target audiences, and strategies. Comparing different approaches can help individuals make informed decisions based on their specific financial needs and circumstances.

Importance of Financial Literacy for Generation Beta: ‘Baby Steps’ Toward Retirement: Prudential Gives Generation Beta A

Generation Beta, those born after the turn of the millennium, face a unique set of financial challenges and opportunities. Their financial landscape is vastly different from previous generations. They’re navigating a world of rapidly changing technology, complex financial instruments, and potentially volatile economic conditions. To ensure a secure and fulfilling retirement, a strong foundation in financial literacy is crucial.Financial literacy is more than just knowing how to balance a checkbook.

It encompasses a comprehensive understanding of how money works, investment strategies, and the long-term implications of financial decisions. For Generation Beta, this knowledge is not just helpful; it’s essential for building a retirement plan that can weather any economic storms. This generation needs to develop a strong understanding of financial concepts relevant to retirement planning, and an appreciation for the power of compounding returns.

They must also develop strategies to navigate complex financial markets and instruments.

Key Financial Concepts for Retirement Planning

A solid grasp of fundamental financial concepts is the bedrock for successful retirement planning. These concepts provide the framework for making informed decisions about investments, savings, and overall financial well-being. Understanding the interplay of these elements is critical for Generation Beta.

- Budgeting and Saving: Creating and sticking to a budget is fundamental. It allows individuals to track income and expenses, identify areas for saving, and prioritize financial goals. A well-defined budget is a roadmap to financial security, and it’s a cornerstone of any sound retirement plan.

- Investing for Growth: Understanding the potential of investment vehicles like stocks, bonds, and mutual funds is critical. While short-term gains can be alluring, long-term growth is essential for retirement savings. This involves understanding the risks and rewards associated with various investment strategies and how to diversify a portfolio for optimal results.

- Debt Management: Managing debt effectively is crucial for long-term financial health. High-interest debt can significantly impact one’s ability to save and invest. Understanding how debt affects financial goals and developing strategies to manage and eliminate debt is vital for a secure future.

- Retirement Planning: Developing a retirement plan early on is essential. This involves estimating retirement needs, considering potential expenses, and choosing appropriate investment strategies to meet those needs. This is not a one-time event but an ongoing process requiring regular review and adjustments as circumstances change.

Understanding Financial Instruments and Markets

Financial instruments are the tools used to navigate the world of finance. The more you understand these instruments, the better you can manage your investments and achieve your financial goals.

- Stocks: Represent ownership in a company. When the company performs well, the value of the stock increases. Stocks can offer significant returns, but they also carry higher risk compared to other investments.

- Bonds: Represent a loan to a government or corporation. Investors receive fixed interest payments over a specified period. Bonds generally carry lower risk than stocks, but potential returns are typically more modest.

- Mutual Funds: Pools of money from many investors used to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management, reducing individual investment risk.

Comparison of Financial Instruments for Retirement Savings

This table provides a basic overview of the key characteristics of different financial instruments. Choosing the right instruments for your retirement portfolio requires careful consideration of your individual circumstances, risk tolerance, and long-term goals.

| Instrument | Risk | Return Potential | Liquidity |

|---|---|---|---|

| Stocks | High | High | Moderate |

| Bonds | Low | Low | Moderate |

| Mutual Funds | Moderate | Moderate | High |

Building a Solid Financial Foundation

Laying the groundwork for a comfortable retirement requires careful planning and consistent effort. This isn’t about a sudden, large influx of funds, but rather a series of strategic decisions and consistent actions over time. Building a solid financial foundation involves establishing sound habits in budgeting, saving, and debt management. These practices, when implemented early, create a powerful engine for achieving retirement goals.Building a strong financial foundation is crucial for Generation Beta, as they face unique challenges and opportunities.

Understanding the nuances of budgeting, saving, and debt management empowers them to navigate their financial journey with confidence and achieve their retirement aspirations.

Taking baby steps toward retirement, Prudential is offering Generation Beta a fantastic head start. It’s all about building those crucial financial foundations, and that often involves understanding the fundamentals of investing. Want to know more about the basics of starting your investment journey? Check out this helpful guide on the essentials of personal finance: Hello world!.

Ultimately, these initial steps will be instrumental in paving the way for a secure retirement for Generation Beta. Prudential’s approach is a great example of how to begin the retirement planning process.

Budgeting: The Cornerstone of Financial Stability

A well-defined budget is the bedrock of effective financial planning. It provides a roadmap for tracking income and expenses, identifying areas for potential savings, and setting realistic financial goals. Creating a budget allows you to visualize where your money goes and identify areas where you can cut back.

- Track Income and Expenses: A crucial first step involves meticulously recording all sources of income and every expense, big or small. This detailed record provides a clear picture of your financial inflows and outflows. This data is the raw material for crafting a personalized budget.

- Categorize Expenses: Organize your expenses into categories (housing, transportation, food, entertainment, etc.). This categorization allows you to identify areas where you might be overspending and potentially cut back. Examples include dining out, entertainment, or subscription services.

- Set Realistic Goals: Based on your income and expenses, establish realistic financial goals. These could include saving for specific items, paying off debt, or increasing your emergency fund. Setting specific targets, like saving $500 per month for a down payment on a house, makes the process more tangible and attainable.

Saving: The Engine of Future Wealth

Saving is the engine that drives your retirement plan. Consistent saving, even small amounts, can compound over time, creating a significant nest egg. Starting early and consistently saving allows for the benefits of compounding interest to work in your favor.

- Early Start is Key: The power of compounding interest means that starting to save early, even with small amounts, yields significant returns over time. For example, saving $100 per month from age 25 to 65 can accumulate a considerable amount with compounding interest.

- Automate Savings: Set up automatic transfers from your checking account to your savings account. This removes the mental barrier of having to remember to save and ensures consistency. It can also be a way to avoid temptation.

- Explore Investment Options: Once you’ve built a solid savings base, consider investing your funds in various instruments. Different investment options like stocks, bonds, or mutual funds offer varying levels of risk and potential return. Consider your risk tolerance and time horizon when choosing investments. This can help your money grow faster and potentially reach your retirement goals earlier.

Debt Management: Clearing the Path to Financial Freedom

High-interest debt can significantly hinder your retirement planning. Prioritizing debt repayment, especially high-interest debt, frees up funds for savings and investment. Understanding and managing debt effectively is essential for long-term financial stability.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first. This approach minimizes the total interest paid over the life of the loan. For example, paying off a credit card with a 20% interest rate before a loan with 5% interest.

- Debt Consolidation: Consolidating high-interest debts into a single loan with a lower interest rate can help reduce monthly payments and save money on interest. This can be a helpful strategy if you have multiple debts with varying interest rates.

- Create a Debt Repayment Plan: Develop a structured plan for repaying debts. This plan should Artikel the amount you’ll pay each month and the timeline for eliminating the debt. This makes debt management less overwhelming and more manageable.

Realistic Savings Goals for Generation Beta

Different life stages require different savings strategies. Young professionals starting their careers might focus on building an emergency fund and establishing a strong savings base. Later, as they advance in their careers, their focus might shift to larger goals like a down payment on a home or investing in retirement accounts.

Budgeting Methods and Effectiveness

| Budgeting Method | Description | Effectiveness in Achieving Retirement Goals | Examples |

|---|---|---|---|

| Zero-Based Budgeting | Allocate every dollar of income to a specific category, ensuring all income is accounted for. | High effectiveness if consistently followed. Encourages awareness of every expenditure. | Allocate $500 to housing, $200 to food, etc. |

| 50/30/20 Rule | Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. | Helpful for establishing spending priorities and savings discipline. | Allocate 50% of $3000 to rent, 30% to entertainment, and 20% to savings and debt repayment. |

| Envelope System | Allocate cash to different categories. This helps visualize and manage spending. | High effectiveness for managing cash flow and avoiding overspending. | Allocate a physical envelope for each expense category, and put cash into the respective envelopes. |

Investment Strategies for Baby Steps

Taking baby steps toward retirement means starting early and building a strong financial foundation. This involves careful planning and understanding investment strategies tailored for long-term growth. Choosing the right investment options early on can significantly impact your future financial security. A well-defined investment strategy is crucial for reaching your retirement goals.Investment strategies should be adapted to your individual circumstances, risk tolerance, and financial goals.

A balanced approach that considers various investment options, diversification, and risk management is essential for long-term success. This approach allows you to maximize potential returns while mitigating potential losses.

Investment Options for Retirement Savings

Various investment options exist for retirement savings. These options offer varying levels of risk and potential returns. Understanding the differences between these options is crucial for making informed decisions. Choosing the right mix of investment vehicles based on your personal circumstances is vital for long-term success.

- Stocks: Stocks represent ownership in a company. Historically, stocks have offered higher potential returns compared to other investment options, but they also come with higher risk. The value of stocks can fluctuate significantly based on market conditions and company performance. For example, the stock market crash of 2008 significantly impacted many investors’ portfolios. However, over the long term, stocks have generally outperformed other asset classes.

Understanding company fundamentals, industry trends, and market conditions is crucial for stock selection.

- Bonds: Bonds represent a loan to a company or government. Bonds generally offer lower potential returns compared to stocks but are considered less risky. Bond prices are affected by interest rate changes. For example, rising interest rates can decrease the value of existing bonds. Bonds are often used to diversify a portfolio and provide stability during market downturns.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Mutual funds offer diversification and professional management. They are suitable for investors who lack the time or expertise to manage their own investments. Different types of mutual funds exist, such as growth funds, income funds, and balanced funds.

Choosing the right mutual fund for your investment goals is crucial.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on exchanges like stocks. They offer diversification and lower expense ratios compared to mutual funds. ETFs can be a convenient way to track specific market indexes or sectors. They offer flexibility and transparency in portfolio management.

Diversification and Risk Management, ‘Baby steps’ toward retirement: Prudential gives Generation Beta a

Diversification is a key aspect of long-term investment success. Diversifying your investments across different asset classes can help reduce risk and increase the potential for higher returns. This strategy can protect your portfolio from significant losses during market downturns. For example, if one sector of the market performs poorly, other investments within your diversified portfolio may offset those losses.Risk management is essential for all investors, particularly those planning for retirement.

Understanding your risk tolerance and aligning your investment strategy accordingly is crucial. Strategies for managing risk can include setting clear investment goals, defining an acceptable level of loss, and consistently rebalancing your portfolio.

“Don’t put all your eggs in one basket.”

This adage highlights the importance of diversification in investment strategies.

Investment Vehicle Comparison

| Investment Vehicle | Potential Return | Risk Level | Suitability for Baby Steps |

|---|---|---|---|

| Stocks | High | High | Potentially suitable for long-term investors with higher risk tolerance. |

| Bonds | Moderate | Moderate | Suitable for investors seeking stability and moderate returns. |

| Mutual Funds | Moderate to High | Moderate to High | Suitable for investors seeking diversification and professional management. |

| ETFs | Moderate to High | Moderate to High | Suitable for investors seeking diversification and low expense ratios. |

Addressing Challenges Specific to Generation Beta

Generation Beta, those born between roughly 1997 and 2012, face unique circumstances in their retirement planning journey. Navigating fluctuating economic landscapes, prioritizing experiences over material possessions, and embracing evolving social norms are just a few factors influencing their approach to retirement savings. Understanding these nuances is crucial for developing effective strategies that resonate with this generation.Retirement planning for Generation Beta is complex, as it involves adapting to an evolving economic environment and adjusting to their distinctive lifestyle preferences.

The traditional “save and invest” approach might not fully address the unique needs and motivations of this generation. This necessitates tailored financial strategies that recognize their priorities and circumstances.

Economic Factors Influencing Retirement Planning

The economic landscape is constantly shifting, making long-term financial planning more challenging. Inflation, fluctuating interest rates, and potential economic downturns can significantly impact retirement savings. Generation Beta faces the prospect of a volatile economic environment during their saving and investment phase. This necessitates diversifying investment portfolios and adopting strategies that can weather economic storms.

Lifestyle Choices and Preferences

Generation Beta often prioritizes experiences and travel over material possessions. This preference shapes their financial decisions, impacting how they allocate funds and approach retirement planning. They often seek financial freedom to pursue their interests and passions, which might influence their approach to retirement savings and investment strategies.

Adapting Financial Strategies to Generation Beta’s Circumstances

To address these unique challenges, tailored financial strategies are essential. A diversified investment portfolio, including stocks, bonds, and potentially real estate, can help mitigate the impact of economic fluctuations. Furthermore, strategies focused on minimizing risk while maximizing potential returns are vital.

Building a Solid Foundation for Future Retirement

A comprehensive retirement plan must account for Generation Beta’s desire for flexibility and experience-driven lifestyle. This necessitates a focus on both financial security and the pursuit of fulfilling experiences.

Investment Strategies for a Flexible Retirement

Investment strategies need to adapt to the unique circumstances of Generation Beta. A balance between growth and preservation of capital is crucial. Strategies like robo-advisors, fractional ownership, and high-yield savings accounts can be considered. Examples of Generation Beta adapting their investment strategy could involve using diversified index funds to capture market growth while also maintaining a significant portion in low-risk bonds to safeguard their capital.

Examples of Adapting Financial Strategies

Generation Beta’s approach to retirement planning can be exemplified by considering a 25-year-old who prioritizes travel. They might choose to allocate a portion of their savings toward a high-yield savings account for short-term goals, while diversifying the remainder into a low-cost index fund for long-term growth. This example demonstrates a blend of short-term needs and long-term financial security.

Examples of Real-Life Cases

Considering the case of a 30-year-old pursuing a career in the creative arts, they might choose a retirement plan that prioritizes flexible income streams. This could include investing in a mix of high-growth stocks and potentially, alternative investments like art or craft collectibles, to potentially leverage their passions for future income. This shows a unique approach that is tied to their lifestyle choices.

The Role of Technology in Retirement Planning

Technology has revolutionized virtually every aspect of modern life, and retirement planning is no exception. Generation Beta, digital natives, are accustomed to leveraging technology for nearly everything, and this familiarity makes it an essential tool for managing their finances and achieving their retirement goals. This section will delve into how technology can empower Generation Beta to navigate the complexities of retirement planning, from managing finances to securing their funds.

Online Tools for Financial Management

Online tools and applications have become indispensable for managing personal finances. These resources provide a centralized platform to track expenses, monitor investments, and create budgets, crucial elements in retirement planning. From budgeting apps to investment platforms, the digital landscape offers a wealth of resources to help individuals make informed financial decisions. Tools like Mint, Personal Capital, and others allow for seamless integration of various accounts, offering a holistic view of financial health, which is paramount in retirement planning.

Cybersecurity in Retirement Planning

Protecting retirement funds is paramount. The increasing reliance on technology for managing financial assets necessitates a robust cybersecurity strategy. Generation Beta needs to be vigilant in protecting their personal information and financial data from cyber threats. This includes using strong passwords, enabling two-factor authentication, and regularly updating software to patch security vulnerabilities. Awareness of phishing scams and fraudulent websites is critical to safeguarding retirement savings.

Strong passwords, combined with multi-factor authentication, are critical to maintaining secure access to online accounts.

Popular Online Retirement Planning Tools

Numerous online tools are designed to assist individuals in planning for retirement. These tools provide personalized projections, track investment performance, and help in making informed financial decisions. The selection of a tool should be tailored to individual needs and financial goals.

| Tool | Key Features | Pros | Cons |

|---|---|---|---|

| Mint | Budgeting, expense tracking, account aggregation, and financial insights. | Easy to use, free, and provides a clear overview of financial health. | Limited investment tracking compared to dedicated investment platforms. |

| Personal Capital | Investment tracking, portfolio analysis, tax planning tools, and retirement planning projections. | Comprehensive investment management tools, personalized retirement projections, and advanced financial insights. | Subscription-based service, potentially higher cost than free options. |

| Vanguard | Investment management, mutual funds, ETFs, and retirement planning tools. | Low-cost investment options, access to a wide range of investment choices, and strong reputation. | May not be as user-friendly for those unfamiliar with investing. |

| Schwab | Investment management, brokerage services, and retirement planning tools. | Wide range of investment options, excellent customer service, and user-friendly interface. | Potential for higher fees compared to some other platforms, especially for active trading. |

Illustrative Case Studies

Retirement planning, for Generation Beta, isn’t just about saving; it’s about building a future where financial security meets lifestyle aspirations. These case studies showcase how individuals have successfully integrated the “baby steps” approach into their retirement journeys, demonstrating the practical application of sound financial strategies and highlighting the importance of consistent effort.

Each story offers a unique perspective, revealing the diverse paths to retirement preparedness. They underscore the crucial role of early planning, adaptable strategies, and the potential rewards of disciplined financial management. These examples aim to inspire and equip Generation Beta with the confidence to embark on their own journeys toward a secure and fulfilling retirement.

Case Study 1: Sarah, the Aspiring Entrepreneur

Sarah, a 25-year-old software developer, recognized the value of early retirement planning. She prioritized building an emergency fund, meticulously tracking expenses, and allocating a portion of her income to investments, including index funds and ETFs. She meticulously researched investment options and used online tools to monitor her portfolio’s performance. Her goal was to generate passive income by 40, allowing her to transition into a less demanding role and pursue entrepreneurial ventures.

Sarah’s journey demonstrates how careful budgeting and diversified investment strategies can accelerate the retirement planning process.

“Starting early and consistently saving, even small amounts, made a significant difference. It’s not about huge returns, but about compounding growth over time.” – Sarah

Case Study 2: David, the Budget-Conscious Professional

David, a 30-year-old accountant, focused on meticulous budgeting and debt reduction as foundational steps toward retirement. He tracked his spending meticulously and eliminated unnecessary expenses. He maximized employer-sponsored retirement plans, contributing the maximum allowable amount and exploring the tax advantages of such plans. He used online budgeting tools to visualize his progress and stay motivated. David’s approach highlights the power of a structured budget and the importance of leveraging employer benefits.

“A well-defined budget is not just about saving; it’s about understanding where your money goes. This clarity allows for informed financial decisions.” – David

Case Study 3: Emily, the Future-Focused Artist

Emily, a 28-year-old artist, recognized the need to plan for both financial security and creative pursuits in retirement. She established a separate savings account for potential art projects or travel during retirement. She explored alternative investment options, including real estate investment trusts (REITs), to diversify her portfolio and potentially generate income streams. Emily’s approach showcases the importance of integrating personal goals with financial planning.

“Diversifying your investments, beyond traditional options, is crucial for achieving both financial and personal aspirations in retirement.” – Emily

Lessons Learned and Applicability

These case studies illustrate the diverse strategies employed by Generation Beta individuals. The common thread is the importance of early planning, consistent effort, and a well-defined financial roadmap. Adopting a “baby steps” approach, whether through disciplined budgeting, consistent savings, or strategic investments, empowers individuals to achieve their retirement goals.

Summary

In conclusion, Prudential’s approach offers a practical framework for Generation Beta to start their retirement journey. By prioritizing financial literacy, taking baby steps toward savings and investments, and understanding the challenges unique to their generation, they can pave the way for a secure and fulfilling retirement. The key takeaway is that early planning, coupled with the right guidance, can make a significant difference.