Helping Others Inspired Preeces Fee-Only Firm

Helping others inspired preece to open fee only financial firm – Helping others inspired Preece to open a fee-only financial firm, a path driven by a profound desire to make a difference in people’s lives. This isn’t just another financial advisory; it’s a testament to the power of putting clients’ needs first. Preece’s firm operates on a unique ethical framework, prioritizing transparency and client well-being over profit margins. This blog dives deep into the motivations behind this approach, exploring the impact on clients, and examining the firm’s innovative business model.

The firm’s approach, rooted in a deep understanding of financial planning, goes beyond simply providing investment advice. It emphasizes building strong, trusting relationships with clients, guiding them through complex financial decisions, and helping them achieve their long-term goals. The core values of the firm, the challenges they’ve faced, and the successes they’ve achieved will all be explored in the following sections.

Motivations Behind Opening a Fee-Only Firm

My journey to establishing a fee-only financial firm stemmed from a deep-seated desire to provide truly unbiased and client-centered financial advice. I recognized a significant gap in the market where financial advisors were often incentivized by commissions, potentially leading to recommendations that weren’t entirely in the best interests of their clients. This realization fueled a commitment to ethical practice and a desire to build a firm grounded in transparency and long-term client well-being.My core values profoundly shaped my decision-making process.

Honesty, integrity, and client advocacy were paramount. I believed a fee-only structure allowed me to focus exclusively on my clients’ needs without the influence of conflicting financial incentives. This approach ensured that my recommendations were driven by data-driven analysis and a thorough understanding of each client’s unique circumstances, rather than external pressures.

Comparison with Other Fee-Only Advisors

While many fee-only advisors share similar motivations, there are nuances that distinguish individual journeys. Common motivations include a commitment to ethical practice, a desire for transparency, and a belief in client-centered advice. However, my personal journey was particularly shaped by my experience working with individuals navigating complex financial situations. This experience honed my skills in developing tailored strategies that addressed specific client needs and helped them achieve their financial goals.

Factors Differentiating My Approach

Several key factors differentiated my motivations from those who chose alternative business models. My focus on providing comprehensive financial planning, incorporating tax strategies, and developing tailored investment portfolios set me apart. My dedication to staying informed about the latest financial market trends and continually updating my knowledge base allowed me to provide clients with cutting-edge solutions.

Impact on Personal and Professional Development

Helping others achieve their financial goals has been profoundly rewarding. This journey has fostered my personal growth by pushing me to continually learn and adapt to the evolving financial landscape. Professionally, it has refined my communication skills, analytical abilities, and problem-solving strategies. The process of working closely with clients has reinforced my belief in the power of collaboration and the importance of building strong, trusting relationships.

I am continuously inspired by the resilience and determination of my clients as they navigate their financial journeys. This experience has instilled in me a deep appreciation for the human element in financial advising and the profound impact one person can have on another’s life.

Impact of Helping Others on Financial Services

Opening a fee-only financial firm wasn’t just about financial gain; it was deeply rooted in a desire to empower others. This commitment has profoundly shaped the way we approach financial advising, emphasizing client well-being above all else. The impact extends far beyond simply managing investments; it’s about fostering a lasting partnership built on trust and shared goals.Our focus on helping others translates into a different kind of financial service experience.

It’s about understanding individual circumstances, anticipating needs, and crafting personalized strategies that address the unique challenges each client faces. This holistic approach, driven by a genuine desire to see clients thrive, differentiates us from traditional financial advisory models.

Positive Effects on Client Financial Well-being

The fee-only model allows us to prioritize client needs without the constraints of external pressures. This translates into customized financial plans that reflect individual goals, risk tolerances, and timelines. Clients benefit from a deep understanding of their financial situation and the tools to make informed decisions. We’ve observed a significant improvement in client confidence and financial literacy as a direct result of our personalized approach.

Comparison with Other Financial Advisory Models

Traditional models often prioritize product sales over client needs. Commission-based structures incentivize the sale of specific products, potentially leading to less tailored solutions. Fee-only models, by contrast, focus on the long-term financial well-being of clients, creating strategies aligned with their unique circumstances and objectives. This difference in approach directly impacts the level of personalized attention and commitment to client success.

Addressing Specific Financial Challenges

One client, a small business owner facing unexpected expenses, benefited from our proactive approach. We helped them develop a comprehensive budget, identify potential cost-saving measures, and explore financing options to weather the storm. Another client, nearing retirement, received assistance in optimizing their investment portfolio to ensure a comfortable and secure retirement income stream. These examples highlight how our firm addresses diverse financial challenges with a client-centric focus.

Ethical Considerations in Fee-Only Advising

Ethical considerations are paramount in fee-only financial advising. We adhere to a strict code of conduct that prioritizes transparency, objectivity, and client best interests. This commitment is critical to building trust and fostering long-term relationships. We maintain rigorous standards to ensure conflicts of interest are avoided, and clients are fully informed about all potential implications of any financial decision.

Impact on Firm Culture and Client Relationships

Our commitment to helping others has deeply shaped our firm’s culture. Employees are empowered to prioritize client needs and foster a supportive, collaborative environment. This emphasis on client-centricity has strengthened our client relationships, building trust and fostering a sense of partnership. Open communication and a focus on shared goals are key elements of our client-centric approach. The result is a strong sense of loyalty and ongoing support that extends far beyond the initial engagement.

Business Model and Operations of the Fee-Only Firm

Building a fee-only financial firm is more than just a business model; it’s a commitment to ethical and transparent financial guidance. It’s about prioritizing the client’s best interests above all else, offering unbiased advice, and fostering a long-term relationship built on trust and mutual understanding. This approach requires a carefully crafted structure, which is the core of this discussion.The fee-only model eliminates the conflicts of interest inherent in commission-based structures.

This allows for a focused approach to helping clients achieve their financial goals without the influence of external incentives. This model, while potentially less lucrative in the short term, fosters a long-term, trusting relationship with clients.

Core Principles and Practices of a Fee-Only Firm

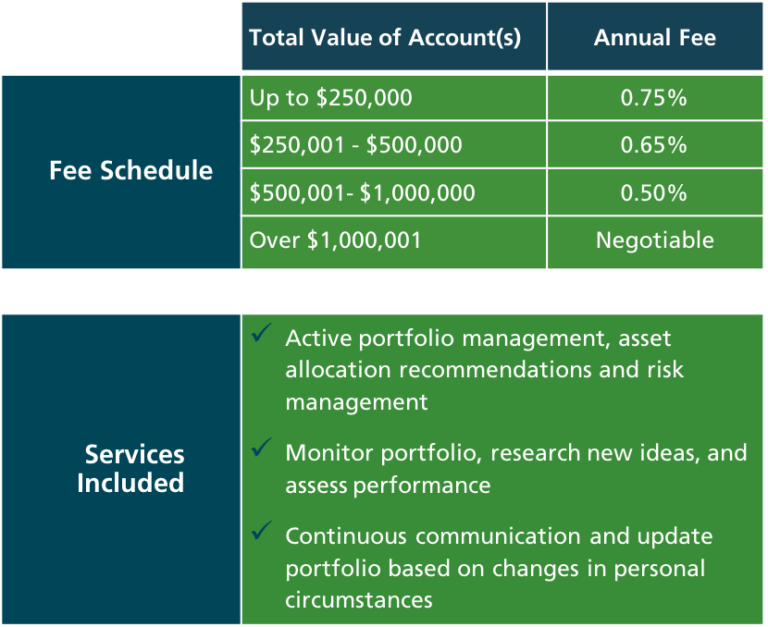

A fee-only financial firm operates on a set of core principles, fundamentally different from commission-based models. These principles are the bedrock of the firm’s operations and ensure clients receive unbiased, personalized advice. Transparency, integrity, and client advocacy are paramount. The firm operates with clearly defined fees and expenses, allowing clients to understand the cost of services.

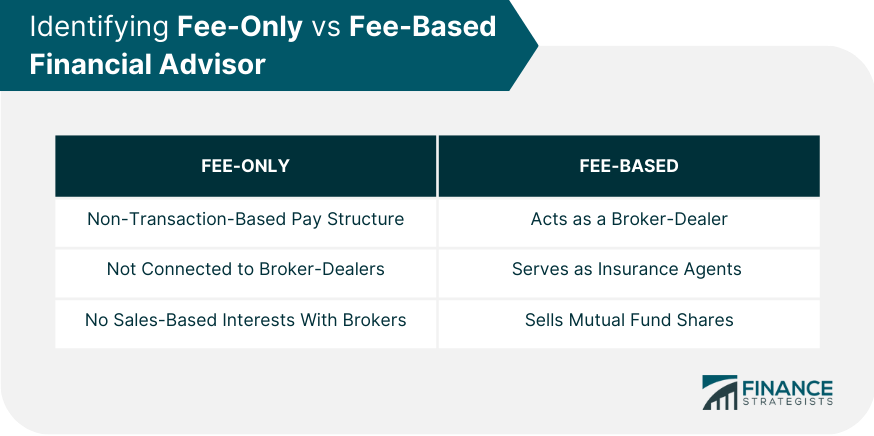

Comparison of Fee-Only and Commission-Based Firms

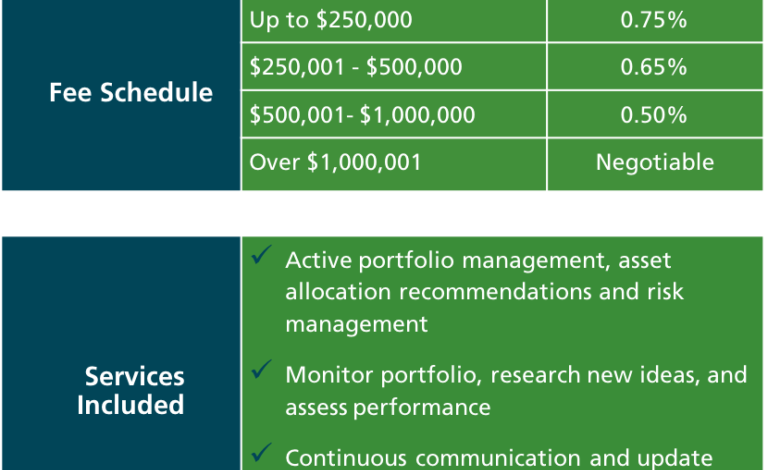

The table below highlights the key differences between fee-only and commission-based firms, focusing on services and compensation structures.

| Feature | Fee-Only Firm | Commission-Based Firm |

|---|---|---|

| Compensation Structure | Fixed fees for services rendered, often based on time spent or complexity of the plan. | Compensation tied to the sale of financial products. |

| Product Recommendations | Recommendations are solely based on client needs and goals, without pressure to sell specific products. | Recommendations may be influenced by potential commissions earned from particular products. |

| Transparency | Detailed fee schedules and service descriptions are clearly Artikeld. | Transparency on commissions and associated costs may be less explicit. |

| Conflict of Interest | Minimized or eliminated as compensation is not tied to product sales. | Potential for conflicts of interest as compensation is directly linked to product sales. |

| Client Focus | Client’s best interest is the primary focus. | Client’s best interest may be secondary to the firm’s profit from sales. |

Financial Planning Process, Helping others inspired preece to open fee only financial firm

Our financial planning process is a collaborative effort between Preece and the client. It’s a journey, not a one-time event. It begins with a thorough needs assessment, exploring the client’s goals, risk tolerance, and financial situation.

- Needs Assessment: Gathering comprehensive data about the client’s current financial situation, including income, expenses, assets, and liabilities. This helps establish a baseline for future planning.

- Goal Setting: Collaboratively defining specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. Examples include retirement planning, college funding, or purchasing a home.

- Strategy Development: Creating a personalized financial strategy tailored to the client’s goals and circumstances. This involves outlining specific steps and timelines for achieving these goals.

- Implementation and Monitoring: Putting the financial strategy into action and continuously monitoring progress. This may involve adjusting the strategy based on changing circumstances or market conditions.

- Review and Adjustments: Regularly reviewing the plan to ensure it remains aligned with the client’s evolving needs and goals. This may involve adjustments to investment strategies or other elements of the plan.

Tools used in the process include budgeting software, financial modeling tools, and investment platforms. Sophisticated software allows for detailed simulations and projections, assisting in making informed decisions.

Financial Products and Services Offered

The table below Artikels the various financial products and services offered by our firm. This comprehensive approach ensures we cater to a wide range of client needs.

Helping others was a driving force behind Preece’s decision to open a fee-only financial firm. It’s clear that ethical practices are key in the financial world, just as the future of sustainable energy looks to alternative materials like graphene and other innovative solutions. the future of sustainable energy looks to alternative materials for a cleaner energy future, mirroring the importance of transparency and trust in financial advising.

This focus on ethical solutions ultimately benefits clients and builds trust, aligning with Preece’s initial motivation for starting the firm.

| Product/Service | Description |

|---|---|

| Investment Management | Developing and managing investment portfolios aligned with client goals and risk tolerance. |

| Retirement Planning | Creating strategies to secure a comfortable retirement, including 401(k)s, IRAs, and other retirement accounts. |

| Estate Planning | Assisting in developing a comprehensive estate plan to ensure assets are distributed according to client wishes. |

| Tax Planning | Strategies to minimize tax liabilities while maximizing returns. |

| Education Planning | Creating plans for funding education expenses, including 529 plans and other educational savings vehicles. |

Client Onboarding and Communication Protocols

Client onboarding and communication are critical to building trust and transparency. Clear communication protocols ensure clients feel informed and empowered throughout the process.

- Comprehensive Client Intake Forms: Collecting all necessary information in a structured format, enabling a thorough understanding of the client’s financial situation.

- Regular Communication: Maintaining open communication through regular meetings, reports, and email updates.

- Detailed Fee Schedules: Providing transparent and accessible fee schedules, ensuring clients understand the costs associated with services.

- Confidentiality and Security: Implementing robust measures to protect client data and maintain confidentiality.

- Feedback Mechanisms: Creating avenues for client feedback to ensure ongoing satisfaction and improvement of services.

The Client Experience and Outcomes

Building trust and fostering long-term relationships are paramount to our fee-only financial planning firm. We prioritize understanding each client’s unique financial situation, goals, and aspirations, tailoring strategies to achieve optimal results. Our approach emphasizes transparency, open communication, and proactive service, ensuring clients feel empowered and confident in their financial future.

Initial Consultation and Assessment

The initial consultation marks the beginning of a collaborative journey. We meticulously gather information about the client’s financial history, current assets, debts, and future aspirations. This comprehensive review allows us to create a personalized financial roadmap. We delve into their investment preferences, risk tolerance, and time horizon to craft a strategy aligned with their unique needs. This thorough process establishes a strong foundation for building trust and mutual understanding.

Building Client Relationships and Trust

Building strong client relationships is fundamental to our success. We prioritize open communication, providing regular updates and actively seeking client feedback. Transparency is key; we explain complex financial concepts in clear, concise language, ensuring clients understand every aspect of their financial plan. Regular check-ins and proactive communication help to address any concerns or questions promptly, fostering a strong sense of partnership.

Helping others was clearly a driving force behind Preece’s decision to open a fee-only financial firm. It’s all about building trust and ensuring clients get the best advice, which resonates deeply with the core principles of providing excellent service. This desire to support individuals in achieving their financial goals, combined with a strong belief in transparent practices, really inspired him to start a business, like the one that focuses on offering a straightforward and honest approach, similar to the spirit of Hello world! This dedication to client well-being was the cornerstone of the firm’s inception, demonstrating a profound commitment to ethical financial practices.

Positive Client Outcomes

Numerous clients have experienced significant improvements in their financial well-being through our services. For example, one client who was struggling with debt consolidation achieved substantial savings through a carefully crafted debt reduction plan. Another client, looking to secure their retirement, saw a significant increase in their retirement nest egg by implementing a diversified investment strategy. These positive outcomes are a testament to the efficacy of our personalized approach and commitment to client satisfaction.

Case Study: Sarah’s Story

Sarah, a young professional with a growing family, approached our firm seeking guidance on saving for her children’s education and securing her own retirement. Through a detailed initial consultation, we understood her desire for stability and long-term financial security. Our comprehensive financial plan included strategies for maximizing savings, investing wisely, and managing potential future expenses. Within three years, Sarah saw a substantial increase in her retirement savings and developed a comprehensive plan for her children’s education fund.

This successful outcome exemplifies the long-term positive impact of our tailored financial planning services.

Long-Term Financial Impact

Our services aim to provide long-term financial security for our clients. We focus on strategies to reduce risk, optimize returns, and achieve financial goals. By proactively managing investments, and addressing potential financial challenges, we help clients navigate life’s transitions with confidence and achieve lasting financial well-being. We monitor market trends and adjust strategies to ensure clients stay on track to meet their long-term financial goals.

Our long-term focus empowers clients to achieve their financial dreams.

Market Trends and Competitive Landscape

The financial advisory landscape is constantly evolving, presenting both opportunities and challenges for fee-only firms. Understanding current market trends and the competitive landscape is crucial for navigating these shifts effectively and positioning a firm for long-term success. This analysis explores the key factors shaping the market, highlighting competitive strategies, and addressing the evolving regulatory environment.The demand for fee-only financial advisors is growing as more investors seek transparent and unbiased advice.

This trend is fueled by the desire for greater control over financial decisions, a growing awareness of potential conflicts of interest in commission-based models, and the complexity of today’s investment options.

Current Market Trends

The rise of digital tools and platforms is dramatically altering how financial advice is delivered. Increased accessibility to information and investment options has empowered clients to conduct more independent research, but it also creates the need for skilled advisors to help clients navigate the complexities and make informed decisions. This means fee-only advisors must embrace technology to streamline processes, personalize client interactions, and provide accessible resources.

Moreover, a focus on holistic financial planning, encompassing not just investments but also budgeting, retirement planning, and estate strategies, is increasingly valued by clients. This necessitates a well-rounded approach from fee-only advisors, going beyond simple investment management.

Key Competitors

Several prominent players dominate the fee-only financial advisory space. Large national firms, as well as regional boutique firms, offer specialized services and varying levels of client support. Independent advisors often focus on specific niches, such as retirement planning, estate planning, or wealth management for particular demographics. Understanding the strengths and weaknesses of these competitors allows for a more effective differentiation strategy.

For example, a firm focusing on high-net-worth individuals might leverage its expertise in complex investment strategies, while a firm targeting first-time homebuyers could excel at providing clear, easy-to-understand financial guidance.

Competitive Strategies

Fee-only firms employ various strategies to attract and retain clients. Some focus on building strong relationships based on trust and transparency, while others prioritize efficiency and technology-driven solutions. Differentiation is key. One strategy might involve specialization in a particular area, such as sustainable investing or international wealth management. Another approach might focus on offering a unique value proposition, like personalized financial education programs or tailored investment portfolios.

A clear understanding of target market and value proposition will enable a fee-only firm to carve out a niche in the competitive landscape.

Regulatory Environment

The regulatory environment for fee-only advisors is continuously evolving. Regulations around fiduciary duty, conflicts of interest, and client disclosures are crucial for maintaining ethical practices. Staying updated on these regulations, and ensuring compliance, is essential to building trust and avoiding potential legal issues. Fee-only advisors should actively engage with regulatory bodies and industry associations to remain informed about emerging standards.

Innovative Approaches

Successful fee-only firms are adopting innovative approaches to enhance the client experience. One example is the use of technology to personalize financial plans and provide clients with real-time insights. Furthermore, integrating robo-advisory tools into their service offerings can broaden reach and potentially reduce costs while still maintaining the value of human interaction and personalized advice. Emphasis on proactive communication, financial education, and ongoing support to clients is also key.

These approaches distinguish firms that prioritize client outcomes and create lasting partnerships.

Final Conclusion: Helping Others Inspired Preece To Open Fee Only Financial Firm

In conclusion, Preece’s fee-only firm stands as a compelling example of how ethical and client-centric practices can thrive in the financial advisory industry. The firm’s commitment to helping others is not just a mission statement; it’s the very foundation of their operations, driving their approach to financial planning and shaping their interactions with clients. This blog has highlighted the key elements of this unique model, from its origins to its impact on clients and the wider financial landscape.

We hope this provides valuable insights for both financial advisors and those seeking expert guidance on their financial journey.