Fintech Cents Evolution and Sensibility

The evolution of fintech cents and sensibility explores the fascinating journey of small-value transactions in the financial technology landscape. From the historical context of early payment systems to the rise of mobile payments, the discussion delves into how technology has reshaped our approach to handling small sums of money. We’ll also examine the impact on financial inclusion, the cultural and societal perceptions surrounding these transactions, and future trends in the sector, including emerging technologies and regulatory implications.

This exploration of fintech’s impact on small transactions reveals the multifaceted nature of financial technology. It highlights how seemingly minor aspects of our financial lives are undergoing significant transformations, driven by innovation and cultural shifts.

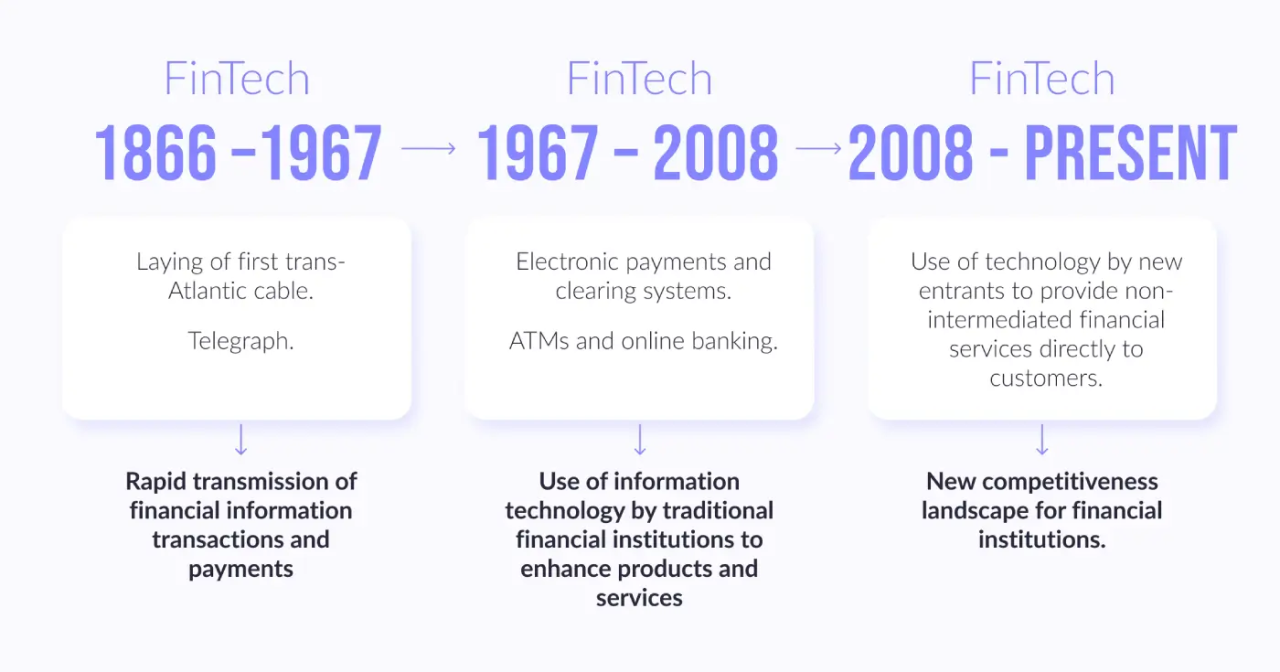

Historical Context of Fintech

Fintech, or financial technology, has dramatically reshaped how we interact with money. This evolution, particularly in the realm of small-value transactions, is a fascinating journey reflecting changing social and economic needs. From the barter system to the modern digital wallet, the methods we use to handle everyday payments have undergone a radical transformation. This exploration delves into the historical development of fintech, highlighting the evolution of small-value transactions and the impact of early digital payment systems.The history of financial transactions is intertwined with the evolution of human societies.

From ancient civilizations exchanging goods to the development of early banking systems, the need for efficient and secure payment mechanisms has always existed. This evolution accelerated significantly with the advent of modern technology, fundamentally altering how we conduct small-value transactions.

Evolution of Small-Value Transactions

The handling of small payments has changed drastically over time. In pre-industrial societies, bartering and local currencies were common. As economies developed, paper money and checks emerged, offering greater convenience and efficiency than earlier methods. The emergence of credit cards and debit cards further simplified transactions, but these were still largely tied to physical accounts and institutions. The digital age, with its online payment systems and mobile wallets, has revolutionized the way we handle small transactions.

Early Digital Payment Systems

Early digital payment systems, while less sophisticated than modern equivalents, had a significant impact on financial transactions. Online payment platforms, like PayPal in its early days, facilitated secure online transactions, a major advancement in the late 20th century. These early systems were crucial for enabling online shopping and other digital interactions, paving the way for more complex and integrated financial technology solutions.

The emergence of these digital systems marked a turning point, shifting the focus from physical currency to digital representations of value.

Comparison of Early and Modern Approaches

Early fintech approaches to small transactions, while effective in their time, were often limited by technology and infrastructure. The limitations in terms of transaction speed, security, and accessibility were considerable. Modern approaches, utilizing mobile wallets, instant payment systems, and APIs, offer significant improvements in efficiency, security, and accessibility. The ease of use, near real-time processing, and global reach of modern systems contrast sharply with the earlier, more rudimentary methods.

Key Milestones in Fintech Evolution

Understanding the evolution of fintech is crucial for appreciating the advancements in small-value transactions. This table highlights some pivotal moments in the development of financial technology.

| Date | Description |

|---|---|

| 1800s | Emergence of paper money and checks. |

| Early 1900s | Development of early credit and debit cards. |

| Late 1990s | Rise of online payment platforms (e.g., PayPal). |

| 2000s | Introduction of mobile payment systems. |

| 2010s-Present | Growth of instant payment systems and digital wallets. |

The Rise of Mobile Payments

The evolution of financial technology has been profoundly shaped by the rise of mobile devices. Smartphones, in particular, have revolutionized how people manage and send money, transitioning from traditional methods to more convenient and often, more secure options. This shift has been driven by the increasing accessibility and sophistication of mobile devices, coupled with the development of innovative payment platforms.The ease and speed of mobile payments have profoundly impacted daily transactions, from small purchases to larger payments.

This shift has not only made financial interactions more convenient but has also opened doors to new possibilities for financial inclusion and innovation, especially in underserved markets.

The Role of Mobile Devices in Small Transaction Management

Mobile devices have dramatically changed how individuals handle small transactions. The convenience of accessing payment apps directly from a phone has made micropayments and everyday purchases significantly easier. Users can instantly send and receive money without needing physical cash or checks. This capability is especially valuable for everyday expenses, peer-to-peer (P2P) transfers, and small business transactions.

Technological Advancements Enabling Mobile Payments

Several key technological advancements have fueled the growth of mobile payments. The development of secure mobile wallets, coupled with advancements in mobile network infrastructure, has enabled seamless transactions. Strong encryption protocols, which are critical for protecting sensitive financial data, are integral to these advancements. Furthermore, the proliferation of near-field communication (NFC) technology has made contactless payments increasingly popular and efficient.

Comparison of Mobile Payment Platforms

Different mobile payment platforms offer unique features and user experiences. Some platforms prioritize speed and ease of use, while others focus on security or specific features like rewards programs or international transactions. Examples include Apple Pay, Google Pay, Alipay, and WeChat Pay. Each platform has its strengths and weaknesses. Apple Pay, for instance, integrates seamlessly with Apple’s ecosystem, while Alipay and WeChat Pay have deep roots in specific markets and offer unique functionalities.

Understanding these differences is crucial for consumers to choose a platform that aligns with their needs and preferences.

User Experience in Mobile Payments for Small Transactions

The user experience associated with mobile payments for small transactions is generally positive. Intuitive interfaces and streamlined processes make these transactions quick and effortless. Users can often complete payments in a matter of seconds, reducing the friction often associated with traditional methods. The immediacy and convenience of mobile payments contribute to a positive user experience, especially for frequent, small-value transactions.

Popularity and Adoption Rates of Mobile Payment Methods

| Payment Method | Approximate Initial Year of Popularity | Current Adoption Rate (Estimated) |

|---|---|---|

| SMS Banking | Early 2000s | Declining, but still present in some markets |

| Mobile Wallets (e.g., Apple Pay, Google Pay) | 2010s | High, rapidly growing |

| QR Code Payments (e.g., Alipay, WeChat Pay) | 2010s | High, particularly in Asia |

| Contactless Payments (NFC) | 2010s | Increasing, significant adoption in many regions |

Note: Adoption rates are estimates and can vary significantly by region and demographic. The table provides a general overview.

Impact on Financial Inclusion

Fintech’s transformative power extends far beyond the realm of convenience and efficiency. Its impact on financial inclusion, particularly for underserved populations, is a crucial aspect of its overall effect on society. This accessibility to financial services can have a profound effect on individual prosperity and community development. By bridging the gap between those lacking traditional banking options and the financial world, fintech empowers individuals to participate more fully in the economy.Fintech solutions are increasingly tailored to the unique needs of marginalized communities, offering alternative pathways to financial services that traditional institutions often overlook.

These solutions often utilize innovative technologies, such as mobile money platforms and digital wallets, to overcome geographical and logistical barriers to financial access. By leveraging the power of mobile devices, fintech can create a more inclusive and equitable financial landscape.

Benefits for Underserved Populations

Fintech offers several crucial advantages for individuals and communities with limited access to traditional financial services. These include reduced transaction costs, increased access to credit, and improved savings opportunities. For example, mobile money platforms allow individuals to send and receive money across geographical boundaries, making it easier to manage remittances and support family members. This is especially valuable for those in rural areas or those with limited access to physical banking locations.

Barriers to Financial Inclusion and Fintech Solutions

Several barriers prevent widespread access to financial services, particularly for underserved populations. These include lack of awareness, high transaction costs, and limited digital literacy. Fintech solutions can address these barriers in various ways. For instance, educational campaigns can increase awareness about digital financial services. Furthermore, innovative fintech platforms can minimize transaction fees, making them more affordable for low-income individuals.

The development of user-friendly interfaces and readily available digital literacy training can significantly bridge the gap in digital skills.

Ethical Considerations

The rapid evolution of fintech presents a range of ethical considerations concerning financial inclusion. The potential for exclusion, discrimination, and exploitation through algorithmic bias in lending or credit scoring systems needs careful attention. Furthermore, ensuring data privacy and security for vulnerable populations is critical. Transparency in terms and conditions, as well as clear dispute resolution mechanisms, is paramount to fostering trust.

Summary Table of Fintech’s Role in Financial Inclusion

| Demographic Group | Specific Fintech Solutions | Benefits | Potential Barriers | Mitigation Strategies |

|---|---|---|---|---|

| Rural Communities | Mobile money platforms, agent banking networks | Improved access to remittances, reduced transaction costs, enhanced financial management | Limited internet access, low digital literacy, lack of reliable infrastructure | Partnerships with local agents, development of offline access points, targeted digital literacy programs |

| Low-Income Individuals | Microloans, peer-to-peer lending platforms | Access to credit, reduced interest rates compared to traditional lenders, improved savings opportunities | Limited credit history, lack of collateral, lack of awareness of platforms | Transparent credit scoring systems, risk assessment models, educational campaigns emphasizing financial responsibility |

| Migrant Workers | Cross-border money transfers, digital wallets | Ease of sending and receiving remittances, enhanced financial control | International transaction fees, lack of trust in digital platforms, language barriers | Partnerships with international financial institutions, multilingual support, secure payment gateways |

The Sensibility of Small Transactions

Small transactions, often overlooked in the whirlwind of fintech innovation, hold significant cultural and psychological weight. From the seemingly trivial purchase of a coffee to the quick payment for a ride, these everyday micro-payments shape our financial behavior and reveal a lot about our societal values. Understanding the sensibility surrounding small transactions is crucial for designing effective and user-friendly fintech solutions that resonate with diverse populations.

These transactions are not just about the amount; they are deeply embedded in our cultural norms and individual perceptions of value.The psychological and behavioral aspects of handling small amounts of money are complex and often influenced by cultural norms. People’s comfort levels with using different payment methods for small transactions vary widely. For instance, some cultures might be more accustomed to cash-based transactions, while others might prefer digital solutions.

Fintech is constantly evolving, and with that comes a shift in how we perceive its value – not just in dollars and cents, but in sensibility too. We’re seeing a move towards more ethical and sustainable practices, a concept that is gaining traction as a whole. This new wave of thought is a critical part of the evolution, reflecting a broader societal shift towards conscious consumption.

It’s exciting to see how these ideas are shaping the future of finance, like the global conversation around responsible investments, and also how this links to Hello world! as we explore new ways to understand and participate in the digital economy. The evolution of fintech cents and sensibility is all about creating a better future for everyone, not just the bottom line.

The perceived risk associated with using digital payment methods for small amounts can also vary significantly across societies, influencing the adoption of new technologies. These nuances are crucial for designing payment systems that are not only technologically advanced but also culturally sensitive.

Cultural Perceptions of Small Transactions

Different cultures have varying perspectives on the value and significance of small transactions. In some societies, a large number of small transactions may be seen as an important part of daily life, often conducted through informal networks and personal relationships. In contrast, other cultures might view these transactions as less significant and more easily managed through formal systems.

This disparity in perception significantly impacts the adoption and usage of fintech solutions for small transactions.

Psychological and Behavioral Aspects of Handling Small Amounts

The psychological impact of handling small amounts of money can be surprisingly significant. The “loss aversion” concept plays a role here; people often feel the pain of a small loss more acutely than the pleasure of a small gain. This can influence how people perceive and react to small transaction fees or charges. For example, a small transaction fee might seem insignificant to someone who views their transaction as significant, while another might feel it’s a significant financial burden.

This understanding is crucial for designing payment systems that are sensitive to these psychological factors.

Trust and Security in Small Transactions

Trust and security are paramount, especially for small transactions. Users need to feel confident that their money is safe and that the transaction process is secure. This is particularly important for those who are new to digital payment methods. Features like secure payment gateways, encryption protocols, and robust fraud detection systems become critical in fostering user trust and adoption.

The perception of trust and security in a fintech platform is often influenced by its reputation, the level of user reviews, and its compliance with regulations.

Comparison of Approaches Across Cultures

The approach to small transactions varies significantly across cultures. In some cultures, cash remains the dominant mode of payment for small transactions, while in others, digital wallets and mobile payment systems are increasingly popular. The relative importance of social interaction and personal relationships in the transaction process also plays a role in shaping the preferences of individuals and communities.

This is further influenced by factors such as the level of financial literacy, access to technology, and the overall regulatory environment.

Cultural Differences in Small Transaction Handling

| Culture | Perception of Small Transactions | Payment Methods | Psychological Factors |

|---|---|---|---|

| North America | Small transactions are often seen as routine and easily managed digitally. | Digital wallets, mobile payments, and credit cards are prevalent. | Loss aversion is a factor in the perception of transaction fees. |

| East Asia | Small transactions are common and often conducted through informal channels, like cash or mobile payment systems with strong social features. | Mobile payments are widespread, often integrated with social platforms. | Emphasis on social interaction and relationship trust often influences payment choice. |

| Sub-Saharan Africa | Cash transactions are still dominant, but mobile money is rapidly growing. | Mobile money is increasingly popular, offering convenience and accessibility. | Trust and security are important considerations, especially in regions with limited banking infrastructure. |

The Future of Fintech Cents

The evolution of fintech has dramatically reshaped how we handle even the smallest financial transactions. From micropayments to peer-to-peer (P2P) transfers, the handling of “fintech cents” has become increasingly sophisticated and efficient. The future promises further innovation, leveraging emerging technologies to create seamless, secure, and accessible solutions for these often-overlooked transactions.The ongoing trend of digitization and the rising demand for accessible financial services will continue to drive innovation in handling small-value transactions.

This will lead to a more integrated and efficient financial ecosystem, ultimately benefiting consumers and businesses alike.

Future Trends in Handling Small-Value Transactions

The future of small-value transactions will be characterized by greater automation, increased accessibility, and enhanced security. Expect to see a rise in automated systems for handling recurring micropayments, such as subscriptions, utility bills, and loyalty programs. The goal is to streamline these processes, reducing friction and improving the overall user experience.

Emerging Technologies Shaping Fintech

Blockchain technology, with its inherent security and transparency, will likely play a significant role in the future of fintech cents. Imagine a system where microtransactions are recorded on a secure, immutable ledger, enhancing trust and reducing fraud. Artificial intelligence (AI) will also become increasingly important, enabling more personalized and efficient solutions for handling these small transactions. AI can analyze patterns in consumer behavior to optimize transaction processing and offer tailored financial products.

For example, AI could predict future needs for small-value payments, allowing users to anticipate and prepare for those transactions.

Innovative Solutions for Small Transactions

Several innovative solutions are emerging to handle small-value transactions effectively. One example is the development of new mobile payment systems that can process very small transactions seamlessly. These systems will likely incorporate features such as integrated budgeting and expense tracking, enabling users to monitor and manage their microtransactions effectively. Furthermore, the rise of decentralized finance (DeFi) platforms may create new avenues for handling small-value transactions through tokenized payments and decentralized exchanges.

Impact on Financial Systems

The integration of these technologies into financial systems will lead to significant improvements. Increased automation and security will reduce costs and improve efficiency for businesses and financial institutions. Furthermore, the accessibility of these technologies will empower unbanked and underbanked populations, promoting financial inclusion and economic growth. The rise of micro-lending platforms, enabled by AI-powered credit scoring and blockchain-based transactions, could democratize access to credit for small-scale ventures.

Potential Future Payment Methods

| Payment Method | Functionality |

|---|---|

| Decentralized Micropayment Protocol | Enables secure and low-cost transactions for small-value exchanges across diverse platforms, using a decentralized network |

| AI-Powered Automated Recurring Payments | Facilitates automated payments for recurring subscriptions, utilities, and memberships, potentially integrating with personal financial management tools |

| Blockchain-Based Loyalty Programs | Provides a transparent and secure platform for accumulating and redeeming loyalty points, enabling instant and verifiable rewards |

| Tokenized Micro-lending Platforms | Facilitates peer-to-peer micro-lending, connecting borrowers with lenders through a secure and transparent platform |

Regulatory Landscape and Implications

The rapid evolution of fintech, particularly in the realm of small-value transactions, has outpaced traditional regulatory frameworks. This has created a complex landscape where innovation clashes with established rules, often leading to uncertainty and potential roadblocks. Navigating this terrain requires understanding the nuances of evolving regulations, the challenges they present, and the opportunities they unlock.The regulatory environment for fintech is not static; it’s constantly adapting to new technologies and business models.

This dynamic nature demands a proactive approach from both regulators and fintech companies to ensure responsible innovation and consumer protection. Effective regulation should foster innovation while mitigating risks associated with new financial instruments and services.

Regulatory Frameworks Governing Fintech, The evolution of fintech cents and sensibility

The global landscape of fintech regulation varies significantly, reflecting the unique financial structures and priorities of different countries. This diversity creates challenges for fintech companies operating internationally, requiring them to navigate different sets of rules and compliance procedures. Regulatory frameworks encompass areas like data security, anti-money laundering (AML), Know Your Customer (KYC), and consumer protection.

Evolving Regulations and Their Impact

Regulations related to small-value transactions are frequently updated to address emerging risks and challenges. For instance, the introduction of mobile payment systems necessitates adaptations in payment card regulations and consumer protection laws. This dynamic environment requires fintech companies to be agile and adapt their operations to comply with the latest regulatory changes. Failure to adapt can lead to significant operational and financial consequences.

Challenges and Opportunities Related to Regulation

One significant challenge is the potential for regulatory “sandboxes” to facilitate innovation while mitigating risk. Sandboxes allow fintech companies to test new products and services in a controlled environment, offering a crucial opportunity for both regulators and companies to learn and adapt. Opportunities arise from a harmonized regulatory framework across jurisdictions, enabling seamless international expansion and fostering a level playing field for all players.

A well-structured regulatory framework can foster trust and confidence in the fintech sector, attracting both investment and talent.

Role of International Cooperation in Shaping Regulations

International cooperation is crucial for establishing consistent and effective regulations in the fintech sector. Collaboration between international regulatory bodies can help avoid conflicting rules and ensure a more predictable regulatory environment. Such cooperation fosters cross-border understanding and enables the development of harmonized standards that benefit both consumers and businesses. International organizations like the Financial Stability Board (FSB) play a vital role in facilitating this cooperation.

Regulatory Differences Across Countries

| Country | Regulatory Body | Key Regulatory Focus | Approach to Small-Value Transactions |

|---|---|---|---|

| United States | Securities and Exchange Commission (SEC), Federal Reserve | Market integrity, consumer protection, financial stability | Regulations evolving to accommodate mobile payments |

| European Union | European Central Bank (ECB), European Banking Authority (EBA) | Financial regulation, consumer protection, cross-border activities | Focus on data security and consumer rights in mobile payments |

| China | People’s Bank of China | Financial stability, national interests, technological advancement | Emphasis on domestic payment systems and digital currencies |

| India | Reserve Bank of India | Financial stability, financial inclusion, economic development | Growing focus on digital payments and financial inclusion |

This table illustrates the diverse regulatory approaches taken by various countries. Differences in regulatory frameworks highlight the importance of international cooperation in fostering a consistent and predictable global regulatory environment for fintech companies.

Technological Advancements and Implications

Fintech’s evolution is inextricably linked to technological advancements. These advancements have not only streamlined payment processing but have also fundamentally reshaped the landscape of small-value transactions, impacting financial inclusion and the overall economy. The shift towards faster, cheaper, and more secure payment methods is a defining characteristic of this era.The implications of these technological leaps are profound. They democratize access to financial services, making it easier for individuals and businesses, especially those previously excluded, to participate in the global economy.

The accessibility of these tools also promotes innovation and entrepreneurship, further driving economic growth.

Payment Processing Technology Advancements

Innovations in payment processing technology have dramatically improved the efficiency and security of transactions. From traditional card networks to mobile wallets and alternative payment methods, the evolution reflects a constant drive for faster, cheaper, and more secure solutions. These developments have had a significant impact on the viability and accessibility of small-value transactions.

Impact of Faster Processing Speeds and Lower Costs

Faster processing speeds directly translate to reduced transaction times and greater convenience for users. Lower costs, driven by technological efficiencies, make small-value transactions more economically feasible for both businesses and consumers. This reduction in costs often allows for increased frequency of transactions, opening new opportunities in areas like micro-payments and peer-to-peer transfers. For example, the rise of mobile payments allows for quick, low-cost transfers, empowering everyday transactions and fostering the growth of micro-businesses.

Role of Secure Payment Gateways

Secure payment gateways are crucial for enabling small transactions. They provide a secure channel for transmitting sensitive financial information, protecting both the user and the merchant. Advanced encryption techniques and fraud detection algorithms are integral components of these gateways, safeguarding against malicious activities. The use of biometrics and multi-factor authentication adds another layer of security, further enhancing the trust and confidence in the system.

Evolution of Transaction Verification and Security Measures

The evolution of transaction verification and security measures is a continuous process, adapting to emerging threats and vulnerabilities. Advanced algorithms and machine learning models are employed to detect fraudulent activities in real-time, minimizing financial losses. The integration of biometric authentication further enhances the security posture, adding an extra layer of protection against unauthorized access. Furthermore, the development of blockchain technology offers potential for greater security and transparency in transactions.

Comparison of Payment Processing Technologies

| Technology | Speed | Cost | Security | Accessibility |

|---|---|---|---|---|

| Credit/Debit Cards | Moderate | Moderate | Good | High |

| Mobile Wallets | High | Low | Good | High |

| Peer-to-Peer (P2P) Payments | High | Very Low | Good (depending on platform) | High |

| Cryptocurrencies | High | Variable | High (with proper security measures) | Moderate (depends on user knowledge and infrastructure) |

This table provides a basic overview of various technologies, highlighting their relative strengths and weaknesses. The specific characteristics of each technology can vary depending on the implementation and associated service provider.

Case Studies of Fintech Success

Fintech companies are reshaping the landscape of small-value transactions, demonstrating remarkable innovation and impact. From streamlining payments to empowering underserved communities, these businesses are driving efficiency and accessibility in the financial sector. This section delves into specific examples of successful fintech companies, analyzing their strategies, innovations, and the market impact they’ve created.These companies are not just improving the user experience but also often addressing systemic issues, such as limited access to traditional financial services.

Understanding their approaches provides valuable insights into the future of financial technology and its potential to transform how we interact with money.

Successful Fintech Companies Focused on Small-Value Transactions

Several fintech companies have achieved significant success by focusing on small-value transactions. Their strategies, often involving innovative technology and a deep understanding of user needs, have resulted in substantial market penetration and positive user experiences. These companies often demonstrate a keen awareness of the nuances of these smaller transactions, which often are more complex to handle than larger transactions.

- Stripe: Stripe is a global payment processing platform that has revolutionized how businesses accept payments. Their API-based approach allows for seamless integration with e-commerce platforms, marketplaces, and other businesses. This has drastically simplified the process of accepting small-value transactions, especially for online retailers and small businesses. Stripe’s robust infrastructure handles high transaction volumes with efficiency and security, crucial for maintaining customer trust in a digital environment.

Their focus on global reach and a variety of payment options for users has contributed to their success.

- PayPal: PayPal’s history of handling small-value transactions spans years. Their platform facilitates peer-to-peer payments, online purchases, and business-to-business transactions. PayPal has evolved to adapt to changing user needs and has integrated various payment methods, making it a ubiquitous choice for small-value transactions. PayPal’s strong brand recognition and established infrastructure have made it a leader in the field, consistently improving and adapting to the demands of modern commerce.

- Square: Square’s innovative approach to point-of-sale systems, combined with their mobile payment platform, has made them a significant player in the small-value transaction space. Their integration of physical and digital payment options offers a versatile solution for businesses of all sizes. Square’s emphasis on simplicity and ease of use, particularly for small businesses, has been instrumental in its success, helping to lower the barriers to entry for digital commerce.

Key Success Factors of Fintech Companies

Successful fintech companies focusing on small-value transactions share several key characteristics. These elements are crucial for achieving market dominance and customer satisfaction.

| Factor | Description |

|---|---|

| Scalability | The ability to handle a high volume of transactions efficiently and securely. This often involves robust infrastructure and sophisticated algorithms. |

| Security | Protecting sensitive financial data is paramount. Advanced encryption techniques and fraud detection systems are essential for building trust with customers. |

| Accessibility | Making services accessible to a broad range of users, including those in underserved communities. This often involves simple user interfaces and a variety of payment options. |

| Simplicity | Clear, intuitive interfaces and user-friendly processes are critical for user adoption. Minimizing complexity and friction is a key component of success. |

| Global Reach | Supporting various currencies and payment methods across different regions is crucial for expanding market reach and supporting international transactions. |

Final Review: The Evolution Of Fintech Cents And Sensibility

In conclusion, the evolution of fintech cents and sensibility showcases a dynamic interplay between technological advancements, cultural contexts, and financial inclusion. From the past to the future, the handling of small transactions reflects broader societal shifts and technological capabilities. Understanding this evolution is crucial for comprehending the future of finance and its potential to impact individuals and communities worldwide.